According to the World Health Organization, it is too early to say that the course of the new strain of the virus is worse than the Delta. It takes several weeks for this kind of conclusion to pass. Then it will be more or less clear what the world is dealing with and how resistant the new virus is to the vaccine. If we talk about contagiousness, then there has been a sharp jump in the incidence in South Africa. This means that the next type of Covid is more easily transmitted from person to person.

Now the flow of negative news related to Omicron has slightly weakened. The markets have time to take a breather, but it's too early to talk about the end of the correction.

The trend towards closing borders for tourists does not continue, much will depend on the incoming news. The next important messages may come today or tomorrow. England on Monday gathered the ministers of the Ministry of Health of the G7 countries to discuss response options. The US president will make a statement on the readiness of the authorities of the leading economies to make painful preventive decisions.

The focus of the markets this week will be the ADP and NonFarm Payroll report for November. Before these publications, representatives of the Federal Reserve are set to speak on Monday and Tuesday. It is unlikely that the markets will calmly react to the comments of officials, in which, as expected, the topic of the new strain will be touched upon. It may be necessary to postpone the Fed's rate hike for a later time. Omicron came at the wrong time, only the US central bank started talking about fighting inflation, which sharply raised expectations of a rate hike, and here it is again...

In general, the mutation from South Africa and the uncertainty associated with this type of virus should not negatively affect the dollar. On the contrary, the greenback's status as a safe haven currency means that it can benefit from the current Covid situation. However, you can't go against the facts, and on Friday it fell on the general emotional imbalance regarding Omicron, and this is a fact. The new type of virus is scary for the dollar because it is seen as a factor influencing when the Fed starts raising rates.

For this reason, ING predicts a decline in the dollar in December, as the Fed may give a back in policy normalization.

Meanwhile, the dollar index has partially reversed Friday's pullback. On Monday, it was moving towards 96.40. Meanwhile, bulls were preparing to break through this year's high - the 97.00 mark. A breakthrough could push the dollar index to a further rally in the 97.80 area. It will be difficult to break through further – there is strong resistance here.

There are no encouraging forecasts for the euro, the EUR/USD pair is likely to strengthen the decline. The eurozone does not cope well with the viral load, besides, geographically Europe is closer to South Africa, which means that a new wave, provided Omicron is highly contagious, will begin here faster than in the US.

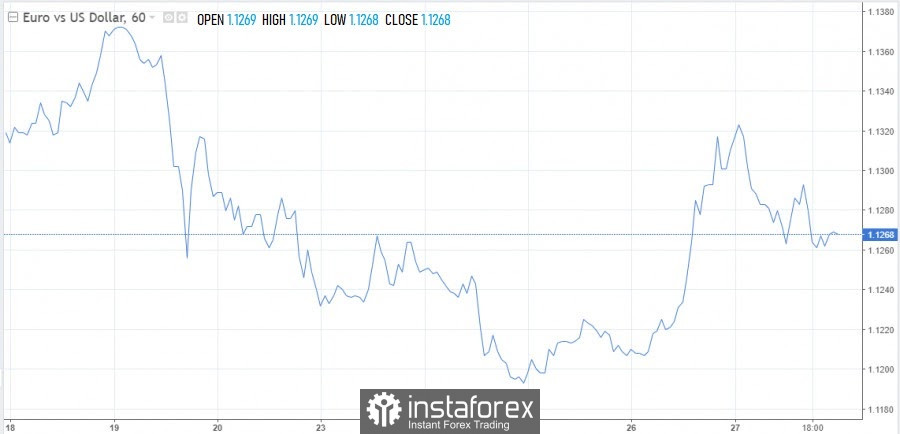

Today, the pair has fallen below 1.1300 again, which indicates a loss of bullish momentum. The bulls' inability to settle above the 13th figure indicates that a downward trend in the euro will develop in the coming sessions, Scotiabank predicts.

After a slight hitch, the goal of pulling the EUR/USD pair to the area of 1.1100, and then to 1.1000 became relevant again. First of all, this is due to the soft position of the European Central Bank and the increased chances of widespread quarantine in the eurozone.

Support is located at 1.1260, then at 1.1230. Resistance is at 1.1300 and 1.1331.

The movement of the USD/JPY pair is of interest now. The yen is now far from where it was a couple of sessions ago (115.00). This suggests that it remains a high beta currency, depending on whether the coronavirus news further affects investor sentiment.

The damage in the USD/JPY pair is significant at the local level. The picture will take on a more threatening look if the reversal low of 112.73 from October is broken. Further, the call will receive an even more significant area of 111.50-111.00.

It looks like this week the markets will be juggling news headlines about the Omicron and in between studying the macroeconomic data for the subsequent delayed reaction. In the absence of positive news, uncertainty could take over, leading to risk trades pulling the market down before things improve.

For a further more serious deterioration in sentiment, there will be little uncertainty; it will take really bad news on the situation with the new virus.

روابط سريعة