Trade Analysis and Advice on Trading the Japanese Yen

The test of the 155.12 price level occurred at a moment when the MACD indicator had already moved far below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the dollar.

Today's speech by Bank of Japan Governor Kazuo Ueda supported buyers of the yen. Ueda noted that at the moment, the regulator can only estimate the neutral interest rate approximately, which indicates the difficulty of future decision-making. However, this does not cancel market expectations for a rate hike as early as next week.

Later today, attention will shift to the publication of weekly U.S. initial jobless claims, as well as layoff data from Challenger. In addition, a speech by FOMC member Michelle Bowman is scheduled. Traditionally, the number of new jobless claims serves as an early indicator of potential changes in the labor market. An increase in this figure may indicate a worsening labor market and a possible slowdown in economic development, which would put additional pressure on the dollar against the yen.

Challenger layoff data also provide important insights, allowing the assessment of employer sentiment and the potential trajectory of the labor market in the near future. However, only very strong U.S. labor market statistics will be able to stop further declines in the USD/JPY pair.

As for the intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Buy Signal

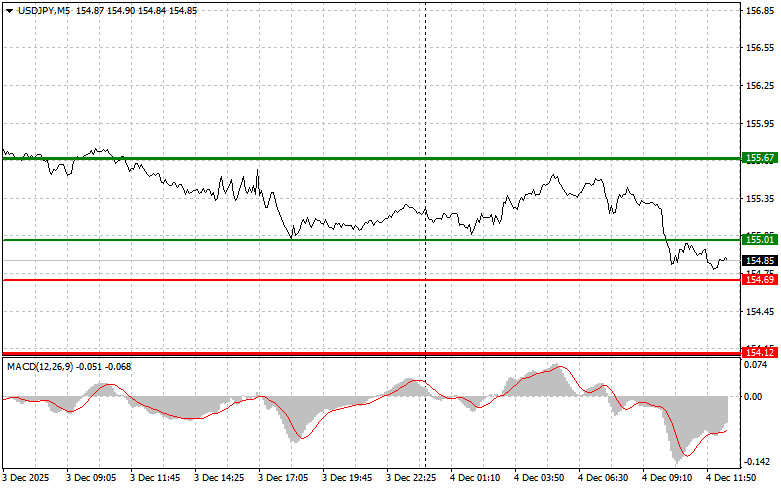

Scenario No. 1: I plan to buy USD/JPY today when the entry point around 155.01 is reached (green line on the chart), targeting growth to 155.67 (the thicker green line on the chart). Around 155.67, I will exit long positions and open short positions in the opposite direction (expecting a 30–35-point downward move). You can count on a rise in the pair only after strong U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to move upward from it.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 154.69 level at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth to the opposite levels of 155.01 and 155.67 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after the 154.69 level (red line on the chart) is updated, which will lead to a rapid decline in the pair. The key target for sellers will be 154.12, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-point upward move). Pressure on the pair will return only in the case of very weak U.S. data.Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 155.01 price level at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline to the opposite levels of 154.69 and 154.12 can be expected.

What's on the Chart:

Important. Beginner Forex traders must make entry decisions very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires having a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.