The EUR/USD currency pair did not show strong movements on Monday. After the pair has worked out the Murray level "1/8"-1.0376 and bounced off it, a slow correction to the moving average line continues. However, this movement is still very difficult to call a "correction", since it is extremely weak. The European currency still cannot oppose anything to the dollar, although, as we have said more than once, the market had the opportunity to work out all the factors supporting the American currency several times. We still believe that the downward trend persists solely due to inertia. Market participants continue to get rid of the euro because it is simple, convenient, and understandable. Why reinvent the wheel if you can just sell the euro currency? Thus, whether there is news or not, there are macroeconomic statistics or not, good reports or not, the US dollar is still growing. There was not a single important event or publication on Monday, so the market had nothing to react to during the day. However, it does not particularly strive to work out every report. Rather, it seeks to find the worst report for the euro or the best for the dollar and work them out, and close its eyes to all other data.

Thus, the technical picture for the euro/dollar pair does not change at all. The price is still located below the moving average line and even in those rare moments when it overcomes it, it cannot show significant growth. At this time, it is even difficult to say what can support the euro, which is still racing to update its 20-year lows and to price parity with the dollar. We believe that we need to wait for only one thing: saturation of the market with euro sales. We have already said that geopolitics and the "foundation" cannot constantly have a destructive effect on one currency. If the conflict in Ukraine persists for several years, will the euro fall all this time? If the Fed rates are higher than the ECB rates over the next few years, will the euro fall all the time? Of course, this option cannot be completely ruled out, but still, we try to be realistic: the euro is not such a weak currency to demonstrate such a scenario.

Finland and Sweden are applying to join NATO.

To be honest, only geopolitics can be discussed now. All the news related to central banks or monetary policies is similar to one another. Inflation is rising everywhere, central banks are trying to keep it everywhere and at the same time not drive their economy into recession, but the dollar is still growing. Therefore, today we will try once again to consider the situation that may develop in the Baltic in the near future. We have already said earlier that the Kremlin opposes the entry of Finns and Swedes into NATO. The Swedes are like the Swedes, but Finland, which in the last 80 years has not been in any blocs and alliances after the start of the "special operation" in Ukraine, absolutely reasonably assumed that at some point Moscow might decide to conduct the same operation on its territory. Therefore, they made a very quick decision to apply for NATO membership. The alliance itself has already stated that it will begin to strengthen both countries immediately to prevent the "Ukrainian scenario" when a country intending to join the bloc does not have time to do so because of Russia's military actions. Thus, from our point of view, there are two options: either Moscow will now have to put up with the fact that NATO bases will be located right on its border, or a new military conflict will begin in the Baltic. Recall that both the Russian Federation and NATO seek to avoid a direct conflict, as it could threaten a Third World War and the destruction of all mankind. However, at the same time, they continue to shake and rattle weapons (including nuclear ones), as well as regularly provoke each other. If earlier it was still possible to say that one side is afraid of the other, now it seems that no one is afraid anymore, so a direct collision is possible. The situation remains very tense.

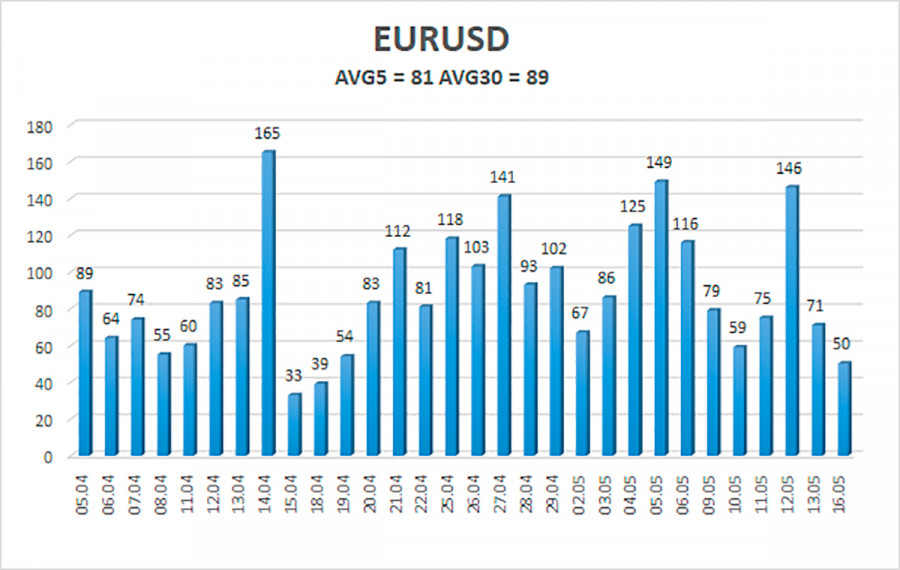

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 17 is 81 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0345 and 1.0507. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The EUR/USD pair continues to form a downward trend, but at this moment a weak upward pullback has begun. Thus, now we should consider new short positions with targets of 1.0345 and 1.0254 in the case of a reversal of the Heiken Ashi indicator down. Long positions should be opened with a target of 1.0620 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.