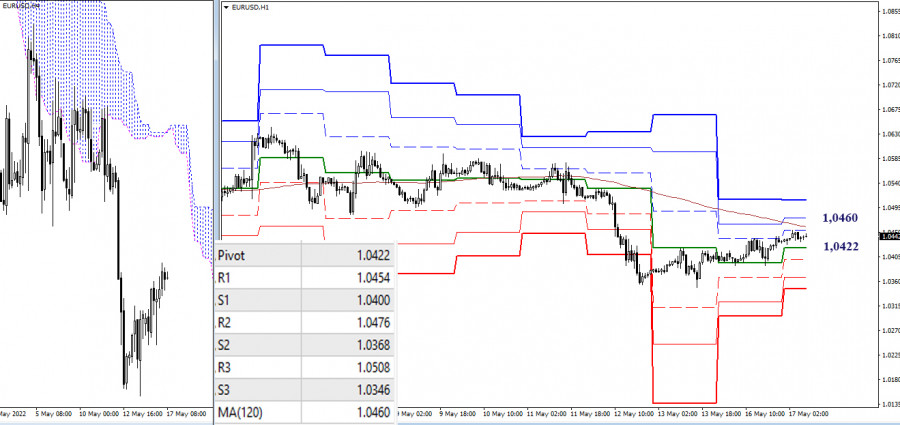

EUR/USD

Higher timeframes

Bulls continue to implement a corrective rally, but the size of the gains is very small. The first target in this situation is the daily short-term trend, which today is located at 1.0495. Further, during the rise, resistance will be provided by the monthly milestone of 1.0539 (100% working out of the monthly target), this level not so long ago was the center of daily consolidation for a long time, and the levels of the daily death cross (1.0573 – 1.0642 – 1.0712). The completion of the correction and the breakdown of support at 1.0339 (the 2017 main bottom) will open opportunities for further decline. In this case, the psychological level of 1.0000 can serve as a reference point.

H4 - H1

The corrective rise continues. In the lower timeframes, the pair approached a key level—the weekly long-term trend (1.0460). Consolidation above and reversal of the moving average can continue to strengthen bullish sentiment and allow players to build new far-reaching plans for an increase. Additional upside targets within the day today can be noted at 1.0476 and 1.0508 (classic pivot points). If the rise is completed and the second key level returns to the side of the bears—now at 1.0422 (central pivot point of the day), there will be prospects for exiting the upward correction zone and restoring the downward trend (1.0349). The extremum (1.0349) is strengthened by the support of the higher timeframes (1.0339), so a breakdown and a reliable consolidation below can greatly help the bears in the subsequent decline.

***

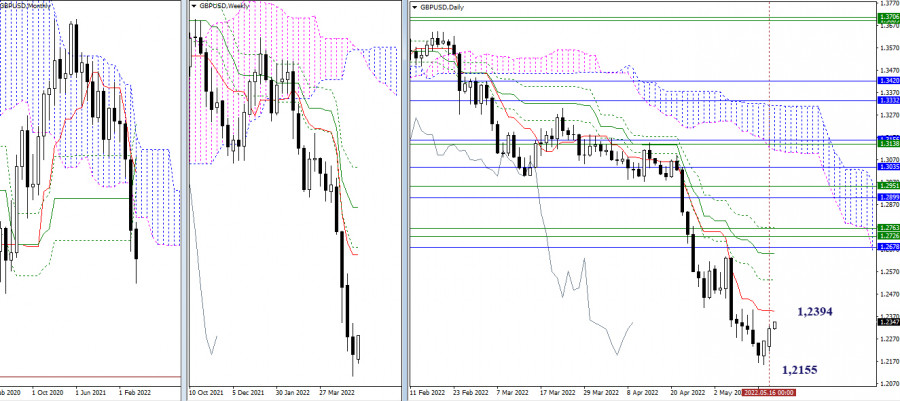

GBP/USD

Higher timeframes

The corrective rise continues. The first daily target of the upward correction is already close—1.2394 (daily short-term trend). When this resistance is overcome, the bulls will have new prospects at 1.2534 (daily Fibo Kijun) and 1.2651 – 1.2767 (a zone of accumulation of levels of different timeframes). The completion of the correction and the restoration of the downward trend is possible through the update of the bottom of 1.2155. Subsequently, the psychological level of 1.2000 may provide support in case of a decline.

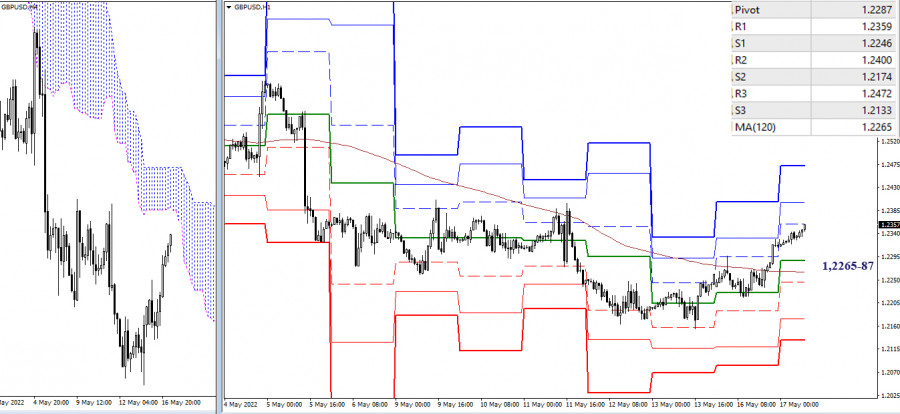

H4 - H1

In the lower timeframes, the pound took over the key levels, turning them into support: today they are located in the area of 1.2265–87 (central pivot point + weekly long-term trend). Consolidation below will change the current balance of power, which is now in favor of the bulls. Upward reference points within the day today are the resistance of the classic pivot points (1.2359 – 1.2400 – 1.2472).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)