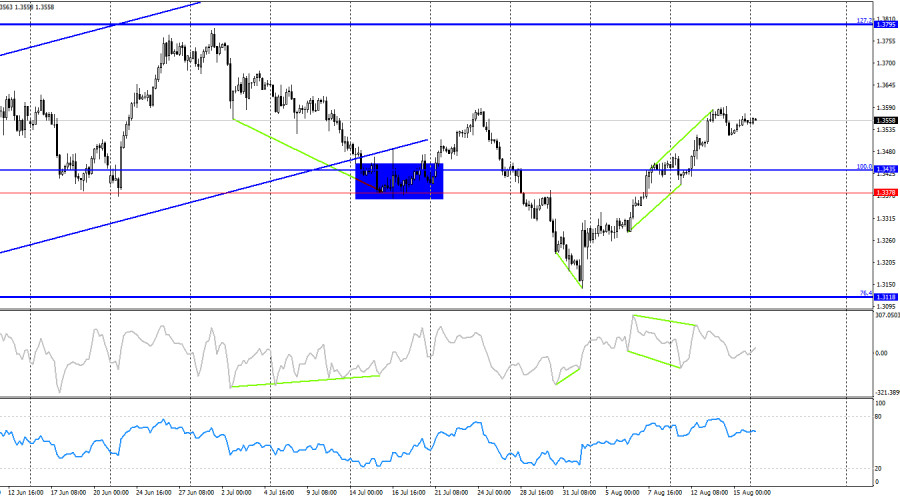

On the hourly chart, GBP/USD on Friday performed a corrective pullback toward the 100.0% retracement level at 1.3586. However, the last trading signal was formed on Thursday — a rebound from the 1.3586 level, and this signal is still valid. Thus, on Monday, further decline toward the 76.4% Fibonacci level at 1.3482 can be expected. A consolidation of the pair above 1.3586 and the resistance zone of 1.3611–1.3620 would support continued growth of the pound toward the next retracement level of 127.2% at 1.3708.

The wave picture remains "bearish," which may sound strange after two weeks of growth. The last completed upward wave broke above the peaks of the previous two waves, but the last downward wave also broke through all prior lows. The news background has played a major role in shaping the wave formations we have seen in recent weeks. In my view, the news flow has already turned the pair toward the bulls, so the trend may soon become "bullish" again. The situation is ambiguous and largely depends on upcoming news.

On Friday, the news background allowed bulls to keep up their pressure. Two of three U.S. reports disappointed: the University of Michigan Consumer Sentiment Index fell to 58.6, and industrial production in July declined by 0.1%. The only relatively positive report was on retail sales, which increased by 0.5% as expected. As a result, the U.S. dollar reasonably weakened in Friday's session, though overall market activity was low. This was particularly true of bearish traders, who often cannot find any real reasons to advance. This week, all attention will be on the Jackson Hole symposium as well as talks between the leaders of the EU, U.S., Russia, and Ukraine regarding a peaceful settlement of the conflict in Ukraine.

On the 4-hour chart, the pair reversed in favor of the pound after a bullish divergence formed on the CCI indicator and the close above the resistance zone of 1.3378–1.3435. Thus, the upward movement may continue toward the next Fibonacci level at 1.3795. A bearish divergence has also formed on the CCI, which signals a potential small decline, aligning with strong resistance on the hourly chart.

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category became more bearish in the last reporting week. The number of long positions held by speculators rose by 8,101, while short positions increased by 13,891. However, the sharp drop in interest toward the pound in the COT report does not fully reflect the actual market situation, as interest in the dollar is also falling. The gap between long and short positions currently stands at about 74,000 versus 113,000. Yet, as we can see, the pound continues to rise.

In my opinion, the pound still has room to fall. For the first six months of the year, the news flow for the U.S. dollar was extremely negative, but it is slowly shifting to a more positive direction. Trade tensions are easing, key deals are being signed, and the U.S. economy in Q2 will recover thanks to tariffs and various domestic investments. At the same time, prospects of Fed monetary policy easing in the second half of the year could create significant pressure on the dollar.

News Calendar for the U.S. and the U.K.:

On August 18, the economic calendar contains no important entries. The news background will not influence market sentiment today.

GBP/USD Forecast and Trading Tips:

Selling the pair was possible on the rebound from 1.3586 on the hourly chart with a target of 1.3482. These trades can be kept open today. Buying the pair requires either a rebound from 1.3482 or a close above the 1.3586–1.3620 zone. Target – 1.3708.

Fibonacci grids are built from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

RYCHLÉ ODKAZY