Měkké přistání zůstává nejpravděpodobnějším scénářem, ale vzhledem k tomu, že rizika recese a stagflace vzrostla poprvé od roku 2022, analytici Wells Fargo varují, že nedávná změna pravděpodobností vyžaduje větší pozornost.

Nejnovější aktualizace Wells Fargo ukazuje, že pravděpodobnost měkkého přistání klesla v prvním čtvrtletí z předchozích 44 % na 40 %, zatímco šance na recesi a stagflaci vzrostly na 27 %, respektive 28 %.

„Pravděpodobnost měkkého přistání klesla poprvé od roku 2022, zatímco pravděpodobnost stagflace i recese vzrostla,“ uvedli analytici.

Ačkoli tento obrat trendu zatím není alarmující, analytici varovali, že

„je třeba jej v příštích několika čtvrtletích sledovat, zejména pokud se nárůst pravděpodobnosti stagflace a recese začne upevňovat.“

Výhled je zatažený nejistotou ohledně obchodní politiky USA. Zatímco Wells Fargo věří, že cla nakonec klesnou na asi 15 % a zůstanou tam až do roku 2026, nelze vyloučit „mírný stagflační šok“.

Analytici očekávají „nerovnoměrný růst HDP v letošním roce, protože spotřebitelské a podnikatelské výdaje poklesnou v důsledku předcelního nárůstu výdajů, ke kterému došlo v 1. čtvrtletí a který pravděpodobně přetrvá i na začátku 2. čtvrtletí“.

Pokud však současná úroveň cel zůstane zachována, riziko stagflace nebo recese by se pravděpodobně zvýšilo v důsledku prudkého růstu spotřebitelských cen.

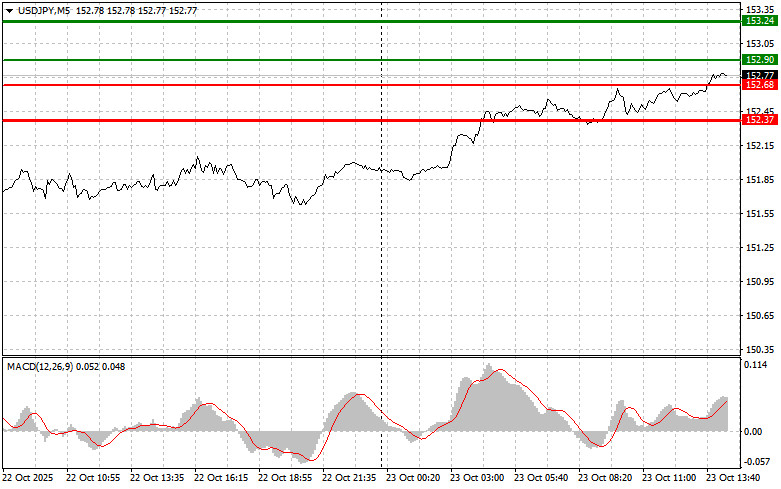

The test of the 152.53 price in the first half of the day occurred when the MACD indicator had just started moving upward from the zero mark. This confirmed a correct entry point for buying the dollar, which resulted in a 25-point rise in the pair.

On the eve of key events, the market is in a state of tense anticipation. The U.S. housing sales report, while important, temporarily loses relevance as traders focus on predicting the Federal Reserve's next moves. The main question determining the future of interest rates is inflation dynamics — whether it is slowing or remaining stable. The speeches by Barr and Bowman will shed light on this. A hint at the need to continue restrictive monetary policy could instantly trigger a surge in the dollar. Conversely, any signs of a more dovish tone — similar to what Waller mentioned yesterday — will immediately pressure the U.S. currency. Many market participants are hoping for this scenario, expecting a continuation of the dollar's weakening trend. In any case, today promises active trading and high volatility. Traders should be prepared for surprises and ready to quickly adapt to changing market conditions.

As for intraday strategy, I'll be relying mainly on scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today around the 152.90 entry point (green line on the chart) with a target of rising to 153.24 (thicker green line on the chart). Around 153.24, I will exit my buy trades and open sell positions in the opposite direction (expecting a 30–35-point move downward). The pair may continue to rise as part of the new trend.Important! Before buying, make sure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 152.68 price, at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 152.90 and 153.24 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after the price breaks below the 152.68 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 152.37, where I plan to close sell positions and immediately open buy positions in the opposite direction (expecting a 20–25-point rebound). Strong downward pressure on the pair today is unlikely.Important! Before selling, make sure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 152.90 price, at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 152.68 and 152.37 can be expected.

Chart Key:

Important Notice

Beginner Forex traders should make entry decisions with great caution. Before the release of major fundamental reports, it's best to stay out of the market to avoid getting caught in sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't use money management and trade with large volumes.

And remember: to trade successfully, you need a clear trading plan—like the one presented above. Spontaneous trading decisions based on current market conditions are, from the outset, a losing strategy for an intraday trader.

RYCHLÉ ODKAZY