On the hourly chart, the GBP/USD pair rose on Monday to the 127.2% retracement level at 1.3186, bounced off it, and showed a slight decline. Today, another rebound from this level would again favor the U.S. dollar, while a consolidation above 1.3186 would increase the likelihood of continued growth toward the next 100.0% retracement level at 1.3247.

The wave structure remains "bearish." The new upward wave did not break the previous high, while the last downward wave (which took about three weeks to form) broke the previous low. The fundamental background in recent weeks has been negative for the U.S. dollar (in my opinion), but bullish traders have not taken advantage of the opportunities to push higher. To complete the bearish trend, growth above 1.3470 or the formation of two consecutive bullish waves would be required.

On Monday, the bulls tried to continue their advance but gave up quickly. Even the news that the U.S. shutdown might end soon failed to give them much "fuel." However, Monday was initially the least attractive day of the week for traders. Today, the U.K. news background looks much more interesting: reports on unemployment, jobless claims, and average earnings have been released. But even these, in my view, are not of major importance. What matters far more are GDP growth rates and inflation. The Consumer Price Index will not be released this week, while GDP growth figures will come out on Thursday.

It is expected that the U.K. economy will grow by 0.2% in Q3, which has been a normal figure in recent years. Moreover, this forecast should be easy to beat — if the economy grows by 0.3% (a modest increase), bulls could feel a much-needed boost of confidence. Overall, I believe the upward process will continue, but technical analysis provides daily clarity on the direction of expected movement.

On the 4-hour chart, the pair continues to move downward within a descending trend channel. If a new bullish trend is now beginning, we will gradually see confirmations of this. I will start expecting a strong rise of the pound only after a close above the channel. Consolidation above 1.3140 allows us to expect further growth of the British currency. No emerging divergences are observed today.

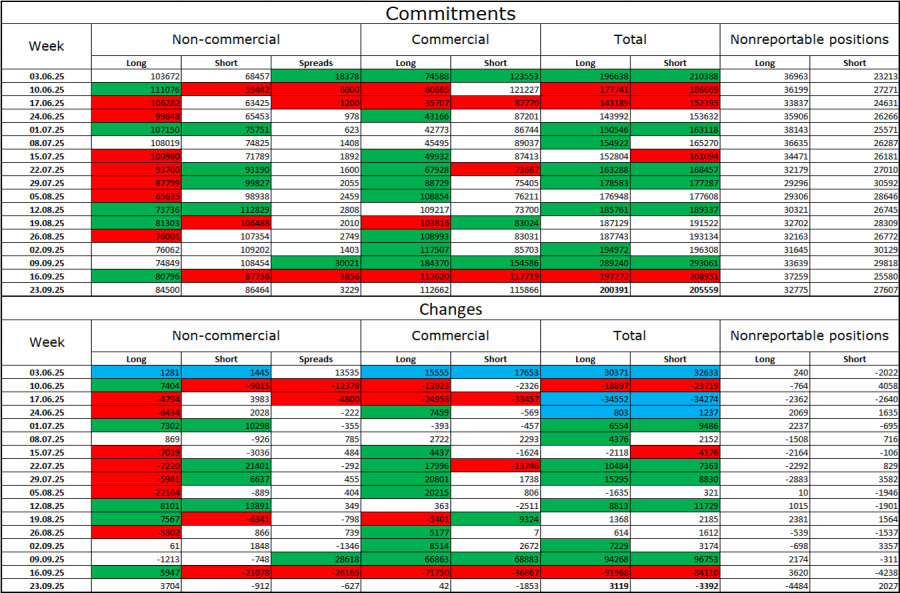

Commitments of Traders (COT) Report:

The sentiment of non-commercial traders became more bullish in the last reporting week — although that report is one and a half months old. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The current gap between long and short contracts is 85,000 vs. 86,000, meaning bulls are once again tilting the balance in their favor.

In my opinion, the pound still faces downward risks, but with each passing month, the U.S. dollar looks weaker and weaker. Previously, traders were worried about Donald Trump's protectionist policies, unsure what results they might bring; now, they are concerned about the consequences of these policies — possible recession, constant introduction of new tariffs, and Trump's conflicts with the Federal Reserve, which could make the regulator appear politically biased. Thus, the British pound currently looks far less risky than the U.S. currency.

News Calendar for the U.S. and the U.K.:

United Kingdom:

On November 11, the economic calendar contains three noteworthy events, meaning that news influence on market sentiment will be present on Tuesday.

GBP/USD Forecast and Trader Tips:

Sell positions are possible today if the price closes below the 1.3110–1.3139 level on the hourly chart, targeting 1.3024, or upon a rebound from 1.3186. Buy positions could have been opened upon a rebound from 1.3024 on the hourly chart, with targets at 1.3110 and 1.3186 — both targets have been reached. New buy positions may be opened upon a close above 1.3186, with a target at 1.3247.

Fibonacci grid levels are built from 1.3247–1.3470 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

RYCHLÉ ODKAZY