The EUR/USD currency pair traded with minimal volatility and exclusively sideways on Thursday. It seems that the market has yet to recover from the macroeconomic data released on Wednesday. Recall that on that day, the unemployment rate in the U.S. decreased to 4.3%, and Non-Farm Payrolls rose to 130,000 in January. At the same time, the Non-Farm value for the entire year of 2025 was revised downwards by nearly half a million jobs, revealing that the American economy created an average of only 19,000 jobs per month last year. In our view, this was yet another reason the dollar hit bottom. Trust in American data diminishes each week because the figures indicate one thing, while objective reality suggests something entirely different. In any case, the dollar maintained its position, the market ignored another set of weak American reports, and determining the trend on the hourly time frame is now challenging.

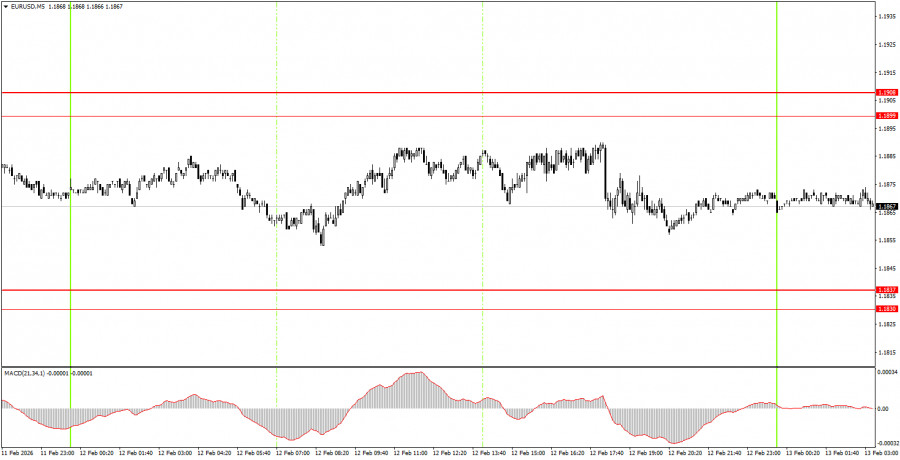

On the 5-minute time frame, there were no formed trading signals on Thursday. Throughout the day, the pair moved only sideways and did not approach any levels. Therefore, beginner traders had no basis for opening positions.

On the hourly time frame, a downward correction is in place, which may soon revert to an upward trend. Recall that the flat movement that lasted for 7 months has ended. If that is the case, a long-term upward trend has resumed at the beginning of 2026. Thus, we anticipate a new medium-term decline of the dollar. The overall fundamental background remains very challenging for the American currency, so we fully support further movement to the upside.

On Friday, beginner traders may consider short positions if the price consolidates below the 1.1830-1.1837 area or if it bounces from the 1.1899-1.1908 area. A consolidation above the area of 1.1899-1.1908 or a bounce from the area of 1.1830-1.1837 will allow for opening long positions with a target of 1.1970.

On the 5-minute time frame, levels to consider are 1.1455-1.1474, 1.1527-1.1531, 1.1550, 1.1584-1.1591, 1.1655-1.1666, 1.1745-1.1754, 1.1830-1.1837, 1.1899-1.1908, 1.1970-1.1988, 1.2044-1.2056, 1.2092-1.2104. No significant events are scheduled in the European Union today. At the same time, the U.S. will release the third important report of the week, which the market may be anticipating: the inflation report.

RYCHLÉ ODKAZY