The GBP/USD pair also traded predominantly sideways on Thursday, but with slightly greater volatility. In the morning, the UK published data on fourth-quarter GDP and industrial production, once again disappointing admirers of the British pound. However, it is worth reminding that the state of the British economy is even worse than that of the U.S. The British pound has been rising for over a year solely because the U.S. dollar is depreciating. Therefore, another batch of poor data from Great Britain was not surprising. The GDP in the fourth quarter grew by only 0.1%, and industrial production fell by 0.9%. The British pound has been slipping for the third consecutive day, although earlier in the week it managed to break the descending trend line, turning the direction upward. The dollar still has a significant number of factors pointing to a decline, but the market is not rushing into new sales.

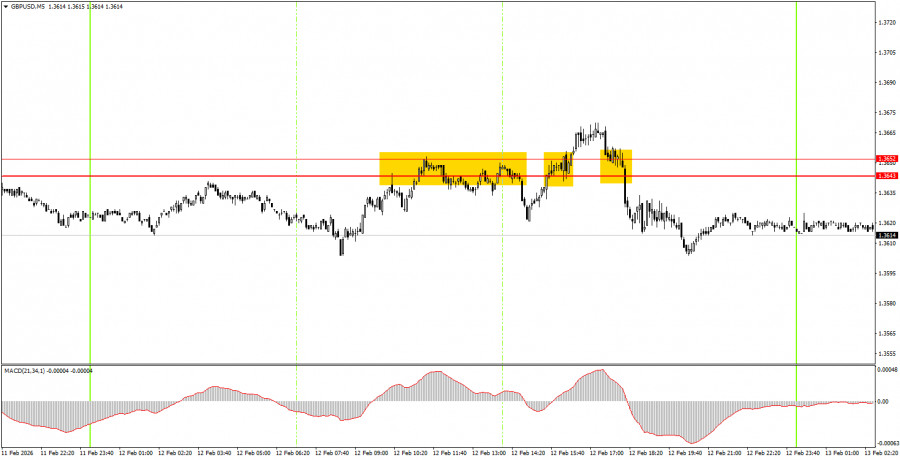

On the 5-minute time frame, three trading signals were formed on Thursday, each leaving much to be desired. It is worth noting that the British data had no impact on the pair's movement during the day. The market ignored it, as well as many other reports in recent weeks and months. The first two signals in the area of 1.3643-1.3652 turned out to be false, and the third signal should not have been traded.

On the hourly time frame, the GBP/USD pair broke the downward trend. There are no global grounds for medium-term dollar growth; therefore, in 2026, we expect the continuation of the global upward trend from 2025, which could take the pair to at least 1.4000. In recent weeks, the situation has often not favored the British currency, and the market, after a few active weeks, is again falling into a state of lethargy.

On Friday, beginner traders may consider short positions if the pair bounces from the 1.3643-1.3652 area, with a target of 1.3529-1.3543. A consolidation above the area of 1.3643-1.3652 will allow for opening long positions with a target of 1.3741-1.3751.

On the 5-minute time frame, you can now trade at levels 1.3319-1.3331, 1.3365, 1.3403-1.3407, 1.3437-1.3446, 1.3484-1.3489, 1.3529-1.3543, 1.3643-1.3652, 1.3741-1.3751, 1.3814-1.3832, 1.3891-1.3912, and 1.3975. There are no important events scheduled in the UK on Friday, while the U.S. will release another important inflation report. Recall that inflation is currently the top priority for the Federal Reserve. Therefore, this report might stir the market and prevent it from slipping into a new hibernation.

RYCHLÉ ODKAZY