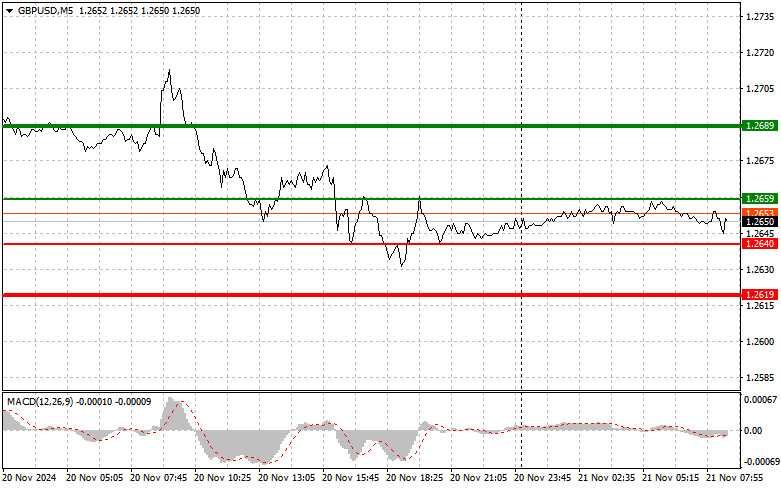

A test of the 1.2654 price level occurred when the MACD indicator had dropped significantly below the zero mark and was in the oversold zone, enabling a scenario for buying the pound. As a result, the pair rose by 25 pips. However, if you missed this signal, you could still capitalize on the next test of 1.2654, which coincided with the start of the MACD indicator's downward movement from zero, confirming a valid entry point for selling the pound. This ultimately led to a decline of more than 30 pips.

Yesterday's rise in the UK Consumer Price Index provided temporary support for the pound, heightening uncertainty surrounding the country's economic outlook. While the data exceeded analysts' expectations, its positive impact on the pound was short-lived. Traders quickly realized that the currency's strength might be unsustainable given global economic pressures and potential changes in the Bank of England's monetary policy. Additionally, the inflation data underscores the challenges facing policymakers. On one hand, rising prices could prompt tighter monetary policy, affecting economic growth. On the other hand, high inflation continues to pressure consumers, reducing purchasing power and public confidence.

Today, a range of reports is expected in the first half of the day, though they are unlikely to significantly influence the currency market. Reports on the UK public sector net borrowing and the CBI Industrial Trends Orders are expected to pass without much market reaction, potentially maintaining pressure on the pound during the morning. I will primarily focus on Scenario #1 and Scenario #2 for intraday strategies.

Scenario #1:

Today, I plan to buy the pound if the price reaches the 1.2569 level (green line on the chart) with a target of 1.2689 (thicker green line on the chart). At 1.2689, I plan to exit purchases and open sales in the opposite direction, aiming for a 30-35 pip movement in the opposite direction. A pound rally today may be possible following strong data. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2:

I also plan to buy the pound today if the MACD indicator is in the oversold zone and the 1.2640 level is tested twice consecutively. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.2659 and 1.2689 can be expected.

Scenario #1:

I plan to sell the pound after the price breaks below the 1.2640 level (red line on the chart), which should prompt a quick decline in the pair. The key target for sellers will be 1.2619, where I plan to exit sales and immediately open purchases in the opposite direction, targeting a 20-25 pip movement in the opposite direction. Selling the pound is preferable at higher levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2:

I also plan to sell the pound today if the MACD indicator is in the overbought zone and the pair tests the 1.2659 level twice consecutively. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.2640 and 1.2619 can be expected.

QUICK LINKS