Donald Trump's tariffs are already starting to bite. The eurozone narrowly avoided stagnation, while the German economy contracted by 0.1% in the second quarter due to U.S. protectionist policies and still-weak domestic demand. The increase in U.S. import duties to 15% suggests that the currency bloc will show very modest GDP growth for the remainder of the year. The contrast with the resurgent U.S. economy is striking. So why shouldn't EUR/USD fall?

As recently as the beginning of the week leading up to August 1, Bloomberg analysts had forecast U.S. GDP growth of 2.4% for April–June. However, after strong foreign trade data, the Atlanta Fed's leading indicator revised the figure upward to 2.9%. The actual result came in at 3%. The thanks go to net exports, which added five percentage points to GDP. In January–March, due to a decline in that same indicator, the U.S. economy had contracted by 0.5%.

Thus, while front-loaded U.S. imports helped the eurozone and hindered the U.S. in the first quarter, roles have now reversed. And this happened during the 90-day grace period granted by Trump. Once that ended, tariffs increased, so the divergence in economic growth and the factor of U.S. exceptionalism will continue to support EUR/USD bears faithfully.

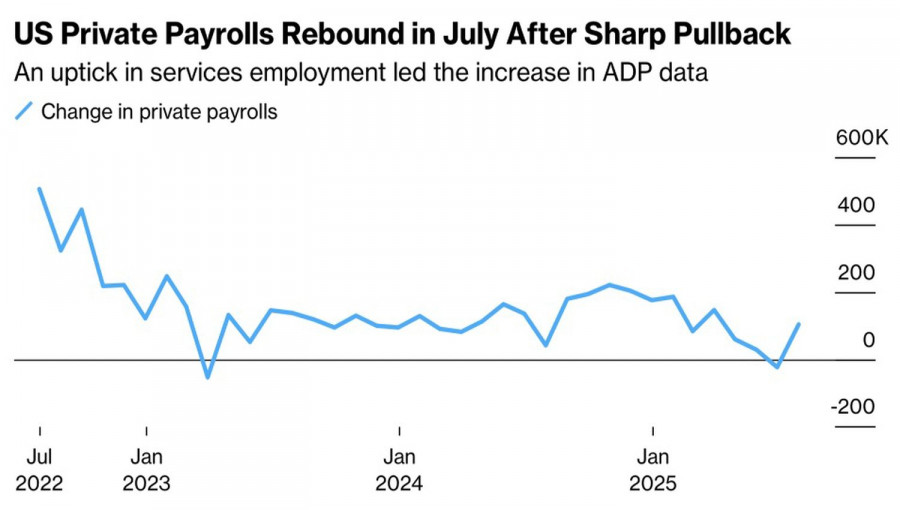

Moreover, the U.S. labor market shows no signs of prematurely falling off a cliff. Yes, job openings declined in June, but ADP's July report showed private sector employment increased by 104,000—well above the Bloomberg consensus forecast of +76,000.

Strong GDP and labor market data effectively tie the hands of the Federal Reserve's doves. Christopher Waller has stated that the central bank doesn't have to wait for the economy to cool before acting. In light of such robust figures, any vote from him in favor of a federal funds rate cut would be seen as dancing to the tune of the U.S. president. I wouldn't be surprised if there are no dissenters in the July FOMC vote. So much for the deepest Fed divide since 1993. In the absence of internal division, the U.S. dollar could further strengthen against major global currencies.

That said, the final say on EUR/USD's trajectory will come from the U.S. nonfarm payrolls report for July. A gain of 110,000 jobs is expected, along with a slight rise in the unemployment rate from 4.1% to 4.2%—still indicative of a strong labor market.

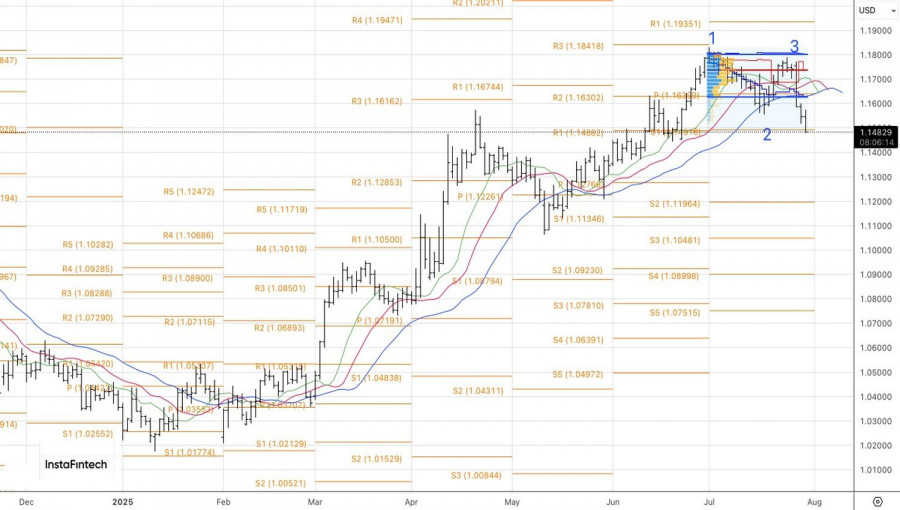

Technically, the EUR/USD daily chart shows a continued downward move. The first of two short-position targets—1.149 and 1.128—has already been reached. The second is now in focus. As long as the pair remains below 1.150, the emphasis should remain on selling.

QUICK LINKS