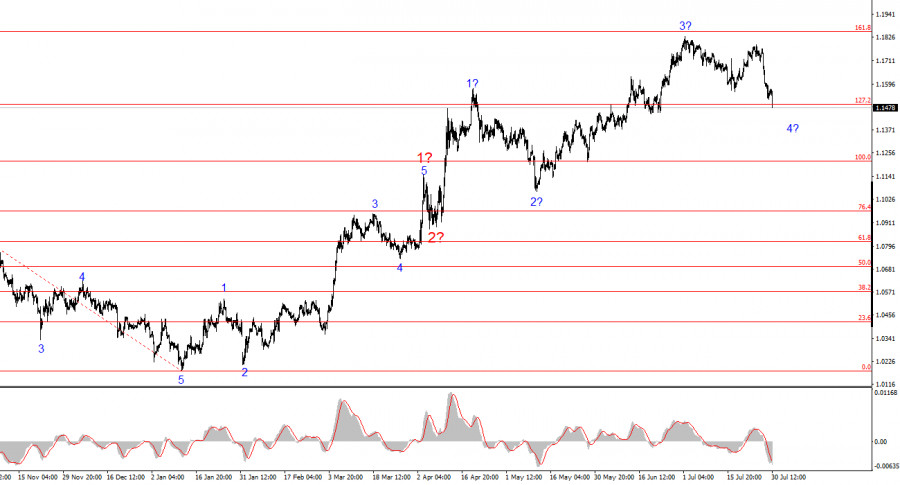

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months. The upward trend segment continues to unfold, while the news background has largely failed to support the U.S. dollar. The trade war initiated by Donald Trump was intended to increase budget revenues and eliminate the trade deficit. However, these targets have not yet been achieved, trade deals are being signed with difficulty, and Trump's "One Big Law" will increase the U.S. national debt by 3 trillion dollars in the coming years. The market has a rather low opinion of Trump's performance over his first six months, and his actions continue to be seen as a threat to American stability and well-being.

Currently, the pair is forming wave 4 in wave 3, which may take the form of a three-wave correction. If this is the case, the wave could complete its formation soon. However, the news background will play a significant role in shaping this corrective structure. Should the U.S. currency gain support, the correction could extend further.

The EUR/USD pair dropped another 80–100 basis points on Wednesday, and again, the move was well-grounded. Later today, the results of the fifth FOMC meeting of the year will be announced. But even before that, GDP reports for the second quarter were released in both the Eurozone and the U.S. — and they gave the market a reason to continue favoring the dollar. Starting with Germany, GDP contracted by 0.1%. While this matched market expectations, it still highlights the economic slowdown in the EU's leading economy. The Eurozone economy grew by 0.1%, which exceeded forecasts, but growth clearly decelerated from 0.6% in the previous quarter.

The real surprise came in the second half of the day: the U.S. GDP report showed the economy expanded by 3% in Q2 — well above the most optimistic estimates of 2.4–2.5% quarter-on-quarter.

Based on this, I conclude that the European reports were quite lackluster, while the U.S. data was exceptionally strong. Despite the high likelihood of rising inflation in the U.S. due to Trump's policies, it's clear that the economy has resumed rapid growth, largely thanks to his trade strategy. I'd also note the ADP employment report, which showed a 104,000 increase in July, far exceeding the 75,000 expected. So nearly all the data released so far has supported dollar buyers. The current decline in EUR/USD fully aligns with the news background and wave structure. I maintain the current wave pattern, which anticipates the development of impulse wave 5 soon.

Based on the EUR/USD analysis, I conclude that the pair is continuing to build an upward trend segment. The wave structure still depends entirely on the news background — particularly Trump's decisions and U.S. foreign policy. This trend segment could potentially reach the 1.25 level. Therefore, I continue to view buying opportunities with targets around 1.1875 (the 161.8% Fibonacci level) and higher. The completion of wave 4 may occur in the coming days, so this week traders should be watching for new buying opportunities while monitoring the news closely.

Key principles of my analysis:

QUICK LINKS