On Thursday, the NZD/USD pair attempted to end a five-day losing streak, supported in part by the consolidation of the U.S. dollar.

The U.S. Dollar Index, which tracks the greenback against a basket of major currencies, edged lower from the two-month high it reached following the Federal Reserve's hawkish tone on Wednesday. Moreover, Fed Chair Jerome Powell did not provide a clear signal regarding a possible rate cut at the September meeting. Nevertheless, dollar bulls are holding off on opening new long positions ahead of the release of key U.S. economic data.

At the same time, the positive sentiment in equity markets is weakening the dollar's position, helping support the risk-sensitive New Zealand dollar. However, disappointing Chinese manufacturing PMI data and a lackluster services PMI for July are acting as a drag on antipodean currencies, including the kiwi. Additionally, ongoing uncertainty about whether the U.S.–China trade truce will be extended continues to weigh on the NZD/USD pair's recovery potential.

Two days of negotiations between U.S. and Chinese officials ended with both sides offering positive remarks about the constructive nature of the talks. U.S. Treasury Secretary Scott Bessent noted that the decision to extend the 90-day tariff truce—set to expire next month—will be made by President Donald Trump. This reinforces market caution, and it may be wise to wait for more decisive upward movement before confirming that NZD/USD has found a bottom.

From a technical standpoint, yesterday's drop below the 100-day simple moving average (SMA) is seen as a key bearish trigger. Daily chart oscillators also remain in negative territory, suggesting that the path of least resistance for the pair continues to point downward. That said, the price attempted to recover above the psychological level of 0.5900 but encountered resistance near 0.5940, which had previously acted as support. A sustained move above the 0.5900 level has not yet been observed.

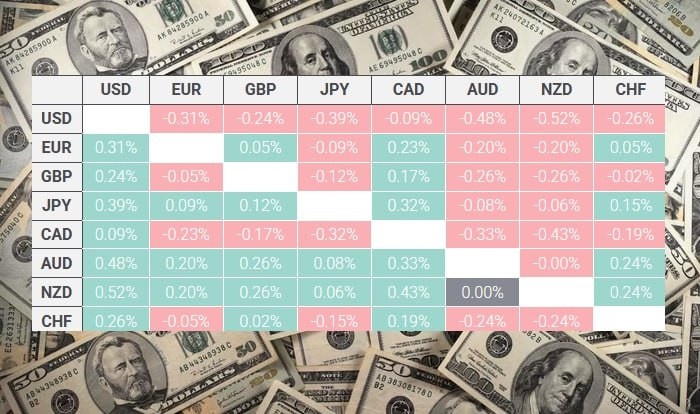

The table below shows today's percentage changes in the U.S. dollar against major currencies. The greenback is currently strongest against the Canadian dollar.

QUICK LINKS