Almost everything in the currency market this week will depend on US economic releases. Of course, we shouldn't forget about the Donald Trump factor, as he continues to fight on two or even three fronts. The first was his confrontation with the Federal Reserve, specifically with Jerome Powell. The second: his battle with the rest of the world over "trade injustice" towards the US. The third: a Ukraine-Russia ceasefire, which Trump needs as much as air. Where Trump will ultimately win and where he will lose is anyone's guess. It's as philosophical a question as the Fed's future actions.

Therefore, I suggest focusing for now on those factors that can be forecasted with at least some degree of probability. The first of these factors is wave analysis, which points to further gains in both instruments. The second is the release of economic statistics throughout the week, which will give market participants time to reassess if needed.

Of all the week's events, I would highlight the ISM business activity indices for the US services and manufacturing sectors, the JOLTS job openings report, the unemployment rate, and the Nonfarm Payrolls. There will be other reports, but these are the most important. Of course, predicting future values for these indicators is just as thankless a task as predicting the future actions of the Fed. If even the US Bureau of Statistics couldn't correctly count jobs in June and July, what can we say for ourselves?

Nevertheless, the probability of seeing weak US data is higher than seeing strong results. In fact, I'll go further: we need to see weak readings in US reports for the news flow not to contradict the wave count. Accordingly, there are two possible scenarios. First, if the news contradicts the wave count and supports the dollar, then I expect the corrective wave structure for both instruments to become more complex; however, I don't expect a change in the overall bullish trend structure. Second: if the news flow does not contradict the wave count, then I expect further price gains for both instruments.

Based on all this, US reports will have priority this week, as they could slightly alter the wave structure. They will also affect the Fed's decision on September 17.

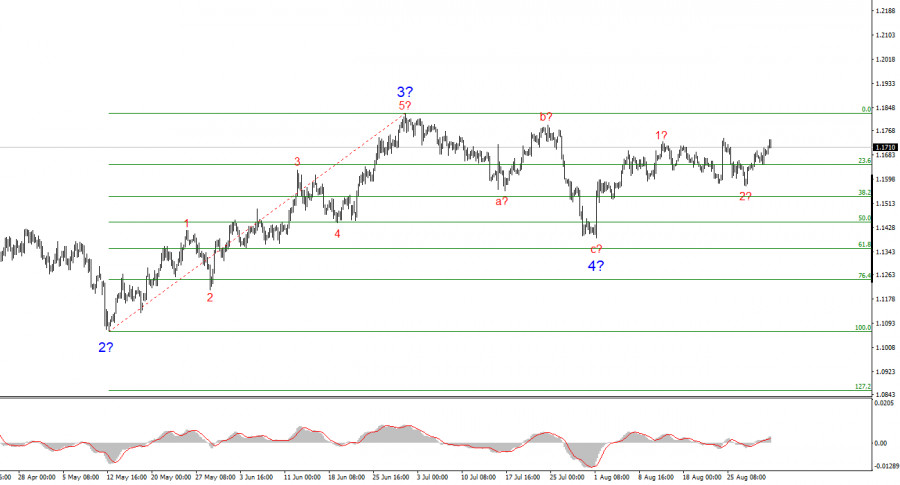

Based on my EUR/USD analysis, I conclude the instrument continues to build a bullish leg of the trend. The wave count still completely depends on the news flow related to Donald Trump's decisions and US foreign policy. The targets for this trend leg may stretch up to the 1.25 area. Therefore, I continue to consider long positions with targets around 1.1875 (which corresponds to 161.8% by Fibonacci) and above. I believe wave 4 is complete. Thus, right now is still a good time to buy.

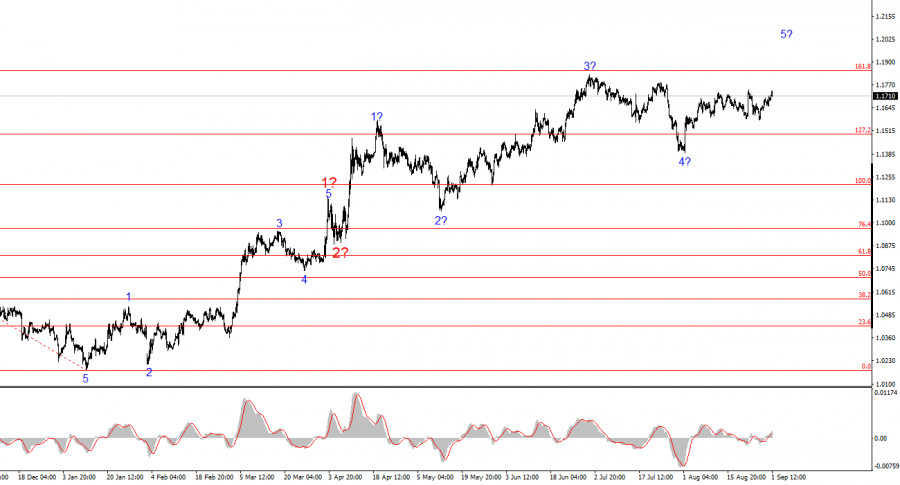

The wave picture for GBP/USD remains unchanged. We are dealing with a bullish, impulsive segment of the trend. Under Trump, markets could still face numerous shocks and reversals that could significantly impact the wave picture, but at this point, the working scenario remains intact. The bullish leg's targets now lie around the 1.4017 level. Currently, I believe the corrective wave 4 is finished. Wave 2 within 5 may also be complete. Therefore, I advise buying with a target at 1.4017.

QUICK LINKS