The EUR/USD currency pair demonstrated strong growth on Thursday and continues to remain in its new upward trend, although the movement is still somewhat weak. It feels like market makers are waiting for the right moment—and that moment has not yet arrived. Recall that the dollar still has every reason to keep falling: nothing has fundamentally improved in the US lately to justify a dollar rally. Yesterday, the ECB decided to keep all monetary policy parameters unchanged, signaling to the market that policy easing won't occur any time soon. Meanwhile, the Fed is set to resume cutting its key rate as early as next week, and in the next year or two could implement major monetary stimulus. If the euro were rising even as the ECB cut rates, what would happen when the Fed starts easing? Thus, expectations should remain for further growth in the European currency, though technicals should not be ignored. For example, a break below the trendline may indicate the start of a new downward move.

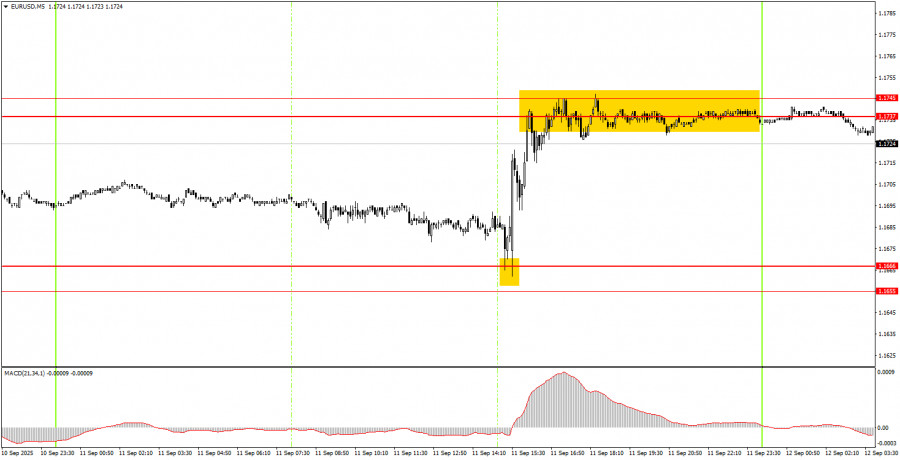

In the 5-minute timeframe, a great buy signal emerged just 15 minutes before the US inflation release, triggering the pair's rally. Novice traders could have opened long positions on the bounce from the 1.1655–1.1666 area, putting their Stop Loss to breakeven 10 minutes later. To be fair, yesterday's signal was quite risky as it formed at the intersection of two major events—the ECB meeting and the US inflation report. Still, it offered a good profit opportunity.

On the hourly chart, EUR/USD has every chance to resume its uptrend, which has been forming since the year began. The fundamental and macroeconomic backdrop remains very bearish for the US dollar, so we still do not expect dollar strength. In our opinion, as before, the greenback can only expect technical corrections. However, a break below the trendline could spark a new technical down move in the pair.

On Friday, EUR/USD may continue its upward movement since the trend remains bullish. However, new longs require a breakout above the 1.1737–1.1745 zone.

On the 5-minute chart, focus on the levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908.

On Friday, the EU will release an unimportant (second estimate) inflation report for Germany. In the US, the University of Michigan Consumer Sentiment Index (a little more important) will be published.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS