Bad news continues to be good news for US equities. For the first time in a long while, the S&P 500 reacted more strongly to jobless claims than to US inflation data. Initial claims jumped to their highest level since October 2021, providing further evidence of a cooling labor market. Investors' belief that this would lead to a cut in the federal funds rate pushed the broad market index to its 24th record of the year.

Dynamics of US stock indices

What matters more to the market: monetary easing by the Fed or the weakness in the US economy reflected in labor data? An MLIV Pulse survey provides the answer. Two-thirds of the 116 investors surveyed believe that the S&P 500 will continue to rise in 2025 thanks to Fed rate cuts. The key condition is that the process remains gradual. Aggressive monetary expansion would make the broad index panic over recession risks.

The main arguments from the minority "bears" on the S&P 500 were growing stagflation risks, overbought conditions in the tech sector, and the potential revival of White House protectionism through new tariffs.

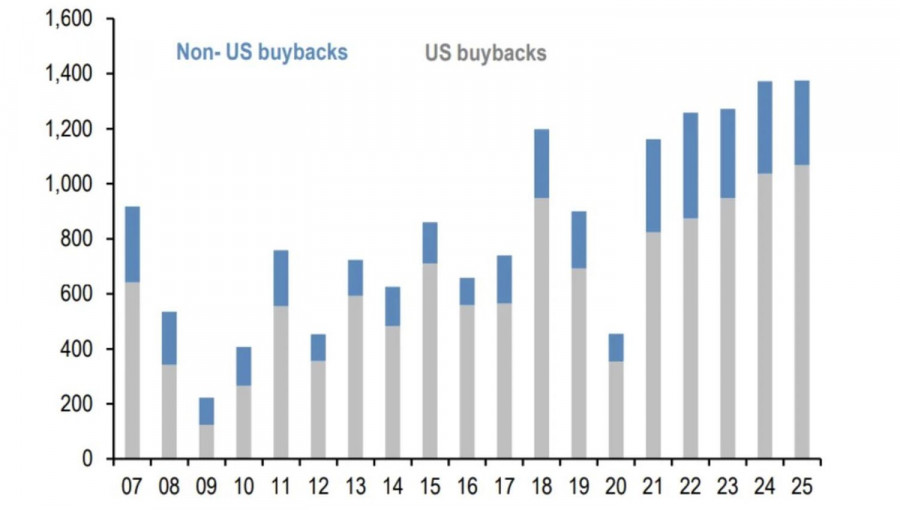

Be that as it may, for now, the optimists far outnumber them. The S&P 500 continues to climb, partly thanks to increased share buybacks, which reduce the supply of equity securities. According to JP Morgan, such operations are set to expand by $600 billion in the coming years after reaching a record high of $1.5 trillion in 2025. The main driver is the return of buybacks' share of market capitalization from the current 2.6% to the pre-pandemic range of 3-4%.

Dynamics of buyback volumes by US companies

New drivers of the S&P 500 rally could include an improvement in Americans' purchasing power thanks to the "big and beautiful" tax cut law, as well as the rollback of White House tariffs following a Supreme Court decision. The Treasury calls this a catastrophe. In August alone, it collected a record $30.1 billion from import tariffs. Since the start of 2025, total collections have reached $171.9 billion, which is $96 billion more than during the same period last year.

Technically, on the daily chart of the S&P 500, a continued rally has pushed the index to the first of the two previously outlined long targets at 6,565 and 6,700. This pivot level is turning from resistance into support. As long as the broad market index trades above it, traders should maintain a focus on buying.

QUICK LINKS