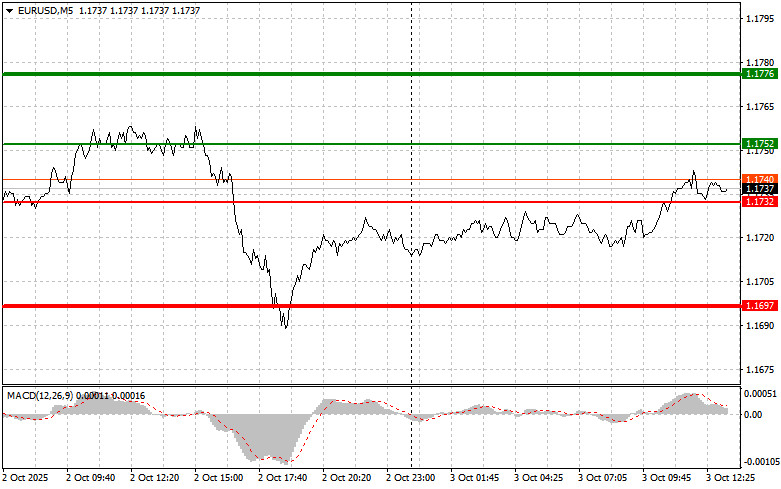

The test of price at 1.1730 coincided with the moment when the MACD indicator had just begun to move upward from the zero mark. This confirmed the correct entry point for buying euros and resulted in a 15-point rise in the pair.

The PMI services activity data from the Eurozone matched economists' forecasts, which at first glance suggests stability and predictability of the economic landscape. However, traders need to keep in mind that these forecasts are based on historical data and current conditions. Therefore, the fact that actual data matched expectations does not mean there are no risks that could disrupt the trend. Despite overall favorable results, there are significant differences between individual Eurozone countries. Germany and France, traditionally the drivers of the European economy, showed more subdued growth in the services sector compared to Southern European countries.

The second half of the day will focus on the release of the ISM Services PMI and the Composite PMI for September. A speech by FOMC member John Williams is also scheduled. Given the absence of U.S. labor market data for September, all attention will shift to these reports. However, the key event will be Williams' speech, as his comments on inflation prospects and the Fed's next monetary policy moves could trigger significant volatility in financial markets. Investors will be looking for signals about when the Fed might continue lowering interest rates and under what conditions.

As for the intraday strategy, I will rely more on Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro at 1.1752 (green line on the chart) with the target of rising to 1.1776. At 1.1776, I will exit the market and also open a sell trade in the opposite direction, targeting a move of 30–35 points from the entry level. Expect euro growth only after weak U.S. data.Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I will also consider buying the euro today if there are two consecutive tests of 1.1732 at the moment when the MACD is in the oversold area. This will limit the downward potential of the pair and lead to a reversal upward. Growth toward 1.1752 and 1.1776 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.1732 (red line on the chart). The target will be 1.1697, where I plan to exit and immediately open a buy position in the opposite direction (expecting a 20–25 point rebound). Selling pressure today will return if U.S. data are strong.Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to move down from it.

Scenario #2: I will also consider selling the euro today if there are two consecutive tests of 1.1752 at the moment when the MACD is in the overbought area. This will limit the upward potential of the pair and lead to a reversal downward. A decline toward 1.1732 and 1.1697 can be expected.

Chart Guide

Important: Beginner Forex traders must be very cautious when deciding on entry points. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you skip money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based only on the current market situation are a losing strategy for intraday traders.

QUICK LINKS