On Wednesday, the EUR/USD pair demonstrated minimal volatility—something traders have grown used to in recent weeks. The U.S. dollar once again attempted to strengthen for no apparent reason, even though there were no important economic events or reports in either the EU or the U.S.

At the time of writing, traders failed to secure a break below the 1.1584 level, though the nature of current price action suggests this level may eventually give way. As such, we continue to observe dollar appreciation that contradicts both the global fundamental picture and even the short-term technical setup.

It's worth noting that nearly all factors remain negative for the U.S. dollar, and the descending trendline on the hourly chart was previously broken. However, an actual bullish trend has yet to materialize. The pair drifts lower almost mechanically each day, losing around 20 pips on average. These movements remain irrational and low in volatility. On the daily chart, the sideways trend (flat) persists, which we believe is the root cause of current market behavior.

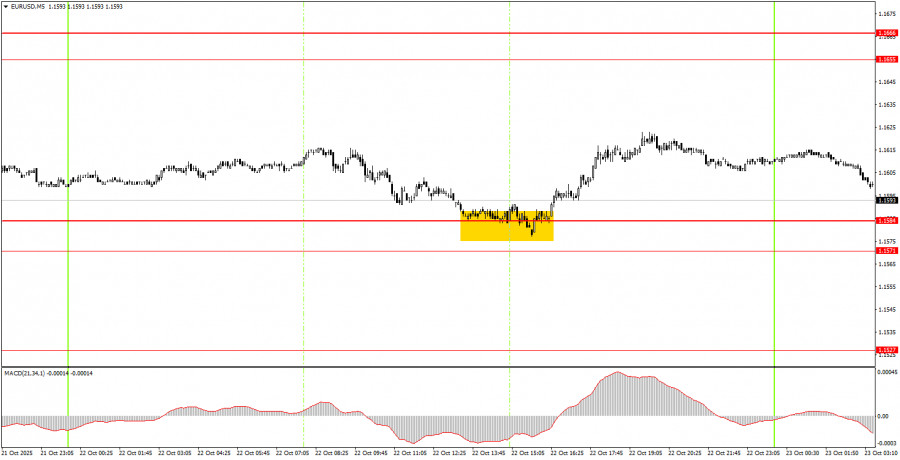

In the 5-minute time frame, one decent trade signal formed on Wednesday. During the start of the U.S. trading session, the pair bounced from the 1.1571–1.1584 zone—providing an opportunity for beginners to open long positions. Due to the lack of volatility, the pair moved upward by only 20–25 pips.

On the hourly chart, EUR/USD is showing early signs of a new bullish trend. The descending trendline has once again been broken, and the fundamental and macroeconomic background remains broadly negative for the U.S. dollar. Accordingly, we continue expecting the renewal of the 2025 uptrend. However, until the flat structure on the daily chart is resolved, we may continue to experience low volatility and erratic moves on the lower time frames.

Since no key macroeconomic events are scheduled for either the EU or the U.S. on Thursday, the pair can move in either direction. New trading signals are most likely to form near the 1.1571–1.1584 zone, which is where the price is currently trading.

Key intraday levels to monitor on the 5M chart: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. Christine Lagarde's frequent speeches in recent weeks have lost their market-moving power, and her recent statements have brought no new information, further reducing fundamental drivers for the day.

Important note: High-impact news events and economic releases (always listed in news calendars) can significantly impact the volatility of currency pairs. During such releases, trade carefully—or exit the market altogether—to avoid aggressive price reversals.

Beginner traders on the Forex market should remember: not every trade will be profitable. The key to long-term success lies in having a clear trading strategy and applying strict money management principles.

QUICK LINKS