Yesterday, US stock indices closed lower. The S&P 500 fell by 0.53%, while the Nasdaq 100 declined by 0.91%. The Dow Jones Industrial Average dropped by 0.71%.

Meanwhile, European indices are approaching new record highs amid a continued flow of strong third-quarter earnings reports. Crude oil prices surged to a two-week high after US President Donald Trump imposed sanctions on major Russian oil producers.

The Stoxx Europe 600 index rose by approximately 0.3%, with energy stocks gaining more than 2%. Futures for the S&P 500 and Nasdaq 100 posted slight increases following yesterday's decline. Gold is trading higher amid the Trump administration's new trade threats, which have heightened tensions between the US and China.

Brent oil prices jumped by nearly 4%, reaching around $65 per barrel after the US blacklisted Russian state giants Rosneft and Lukoil, citing Moscow's lack of commitment to peace in Ukraine. Refinery executives in India, a key buyer of Russian crude, stated that the imposed restrictions would make future deliveries impossible. Washington's decision immediately impacted global energy markets, sparking concern over potential supply disruptions.

Experts largely agree that sanctions targeting Russia's largest oil producers are likely to lead to reduced production and exports, which in turn will drive prices higher. The situation in India is particularly worrisome, as Russian oil remains in high demand there due to its competitive pricing. Announcements from Indian refineries regarding the inability to continue imports following the sanctions could trigger shortages and rising fuel prices in the country, potentially weighing on the broader economy.

As for China, the Trump administration stated yesterday that it is considering restricting software exports to China, stirring fears of renewed trade tension escalation. In the US, the biggest losses were seen in assets favored by retail traders, including precious metals stocks, cryptocurrencies, and AI-related companies.

Currently, Chinese officials are concluding the Fourth Plenary session in Beijing, with a public statement on outcomes expected later today. It is anticipated that Treasury Secretary Scott Bessent will meet with his Chinese counterpart over the weekend ahead of the upcoming Trump-Xi summit.

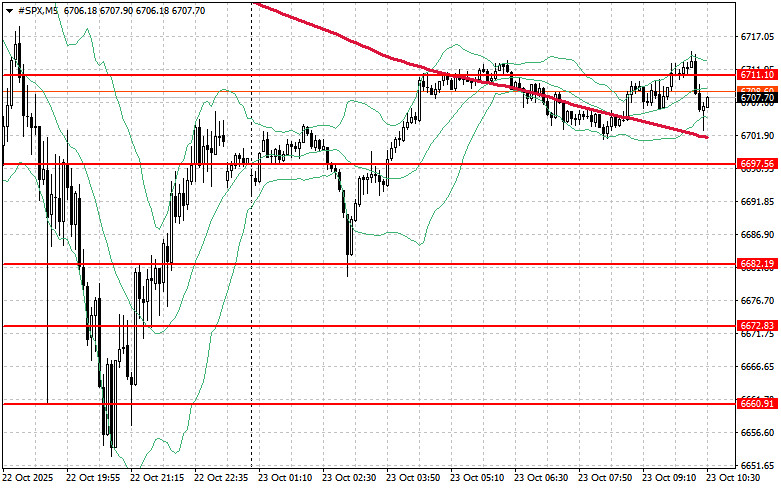

Regarding the technical picture of the S&P 500, the key task for buyers today will be to break through the nearest resistance level of $6,711. This would help the index to show upward movement and potentially pave the way for a push toward the $6,727 level. An equally important objective for bulls will be maintaining control above the $6,743 mark, which would further strengthen their position. In the event of a downward move due to declining risk appetite, buyers must assert themselves near the $6,697 area. A break below this level would likely push the trading instrument back to $6,682 and may open the path toward $6,672.

QUICK LINKS