There are virtually no macroeconomic reports scheduled for Wednesday. An inflation report will be released in Germany as a second estimate for October, but it is important to note that second estimates are inherently much less significant than first estimates, and deviations from the first estimate are quite rare. In any case, inflation in the Eurozone (and especially in a single country) has almost no impact on the European Central Bank's monetary policy at this time. Inflation in the Eurozone has stabilized around the 2% mark, which is what the central bank aimed to achieve.

There are quite a few fundamental events scheduled for Wednesday, but almost all are of little interest. In the Eurozone, ECB representatives Luis de Guindos and Isabel Schnabel will give speeches, but the market currently has no questions for them. The ECB clearly indicated a week ago that no changes in monetary policy are expected in the near future. In the UK, the Bank of England's Chief Economist, Huw Pill, will speak, which could be interesting, as the latest meeting of the British central bank ended with a "borderline decision" to maintain the key rate at its previous level. In the US, speeches will take place from Federal Reserve members Raphael Bostic, Stephen Miran, and Michael Barr.

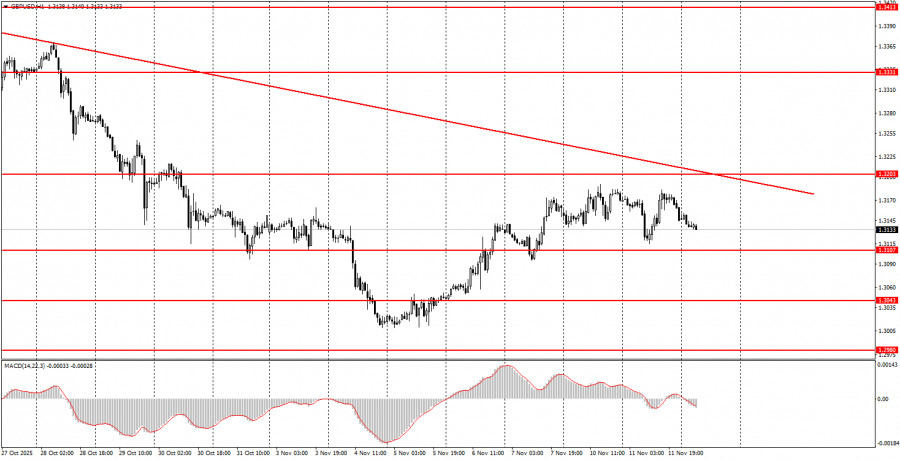

During the third trading day of the week, both currency pairs may attempt to continue moving upward. New long positions for the euro will become relevant upon a rebound from the area of 1.1571-1.1584, targeting 1.1655. New longs for the pound will become possible upon a price rebound from the area of 1.3096-1.3107. The growth of both currency pairs in recent days has been weak and unstable, so novice traders may also consider short positions.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

QUICK LINKS