Hour by hour, the situation grows more complicated. First, Donald Trump was raising tariffs; now the current US president is cutting them. Seeking to slow inflation, the White House plans to reduce import duties on food products from several Latin American countries. How should the US dollar react? If it has been falling since Independence Day, why wouldn't the USD Index rise now? Yet another puzzle for investors, who already have plenty to worry about on the Forex market as autumn draws to a close.

The key question is: why is the US dollar weakening when the odds of a federal funds rate cut in December are falling? Normally, the opposite happens. Such derivative signals usually trigger selling in EUR/USD—but not this time. Why? It seems the market trusts its ears more than its eyes. Alternative data points to cooling employment and accelerating inflation, yet investors prefer to wait for official statistics.

US inflation dynamics

The Federal Reserve's "hawkish" rhetoric leaves the door open for a possible reduction in borrowing costs at the end of 2025. Derivatives currently price the odds at fifty-fifty—down from 72% just a week ago. Lower probabilities put pressure on stock indices. In theory, a decline in the S&P 500 should strengthen the US dollar. In practice, it hasn't.

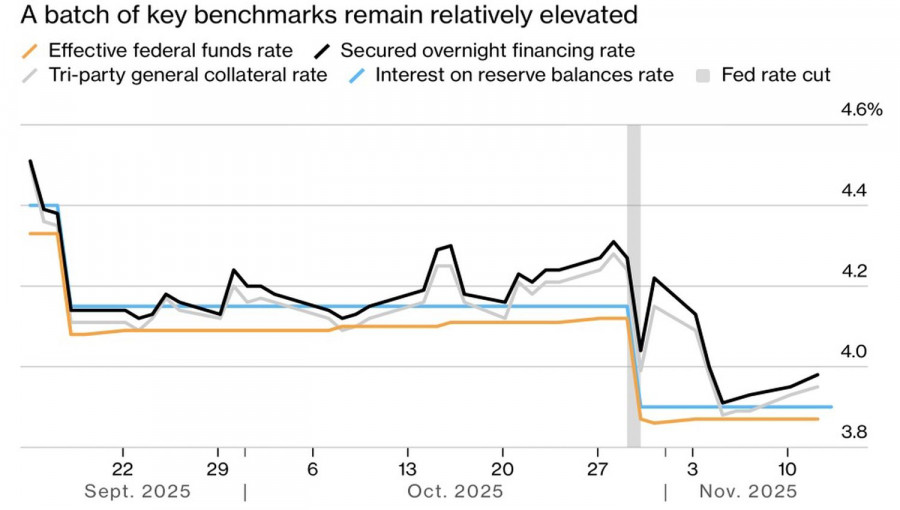

The greenback is behaving like a risk asset, falling alongside the US equity market. The USD Index is under pressure due to rumors that the Federal Reserve may soon resume its asset-purchase program. Credit-market rates have risen due to liquidity shortages, and the central bank isn't happy about it. A shift toward balance-sheet expansion would be a bullish factor for EUR/USD.

Fed rate dynamics vs. credit market rates

According to an ING survey, 40% of investors believe the euro will trade in the $1.20–1.25 range for most of 2026. Another 36% expect $1.15–1.20. Only 2% foresee the common currency climbing above $1.25, while 4% predict a drop below $1.10. ING itself forecasts EUR/USD at 1.22, supported by fiscal stimulus and accelerating eurozone GDP growth.

Validus Risk Management argues that the US dollar is overvalued even after its 10% decline in the first half of the year. The firm believes Donald Trump will soon renew his pressure on the Fed to aggressively cut rates. Eroding confidence in the greenback, fueled by the US president's attacks on the central bank, could strengthen the bullish case for EUR/USD.

By contrast, Bank of America expects the USD Index to rise from current levels, noting that the dollar has become more sensitive to interest rates and that markets have overestimated the extent of the Fed's monetary expansion.

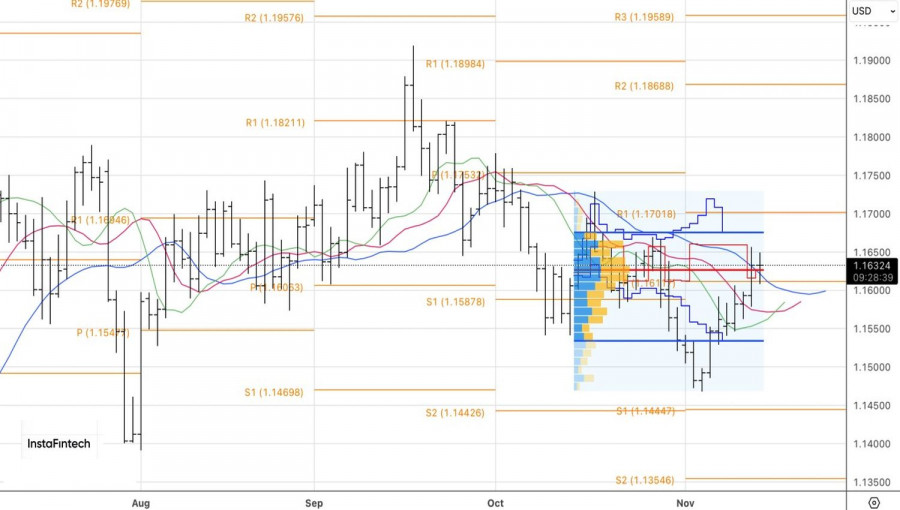

From a technical standpoint, the daily EUR/USD chart shows a return to fair value at 1.1625. An inside bar has formed, allowing for long positions on a breakout above $1.1650 and shorts on a move below $1.1605.

TAUTAN CEPAT