The first test of the 155.47 level occurred when the MACD indicator had just started moving upward from the zero line, confirming the validity of entering a long position on the dollar. As a result, the pair rose by 100 points.

The Bank of Japan's decision to keep interest rates unchanged had a significant impact on the Japanese yen, leading to its sharp decline against the US dollar. Following the Federal Reserve's stance yesterday, this move by the Japanese regulator was interpreted as a step back from its earlier commitments. Investors expecting tighter monetary policy in response to rising inflation were left disappointed. The unexpected depreciation of the yen against the US dollar raises concerns about Japan's economic stability and its ability to cope with global economic challenges.

After the Japanese regulator's decision, traders began revising their forecasts. Many market participants now expect this development to lead to further yen weakness, potentially causing additional volatility in the forex markets. Moreover, increasing expectations for tighter Federal Reserve policy make the yen less attractive to foreign investors. While the duration of this trend remains uncertain, the negative impact on the yen is already evident.

In the second half of the day, US data on initial jobless claims and GDP changes will be released. Strong figures could trigger another sell-off in the yen and push USD/JPY higher. For intraday strategy, I will focus on Scenario #1 and Scenario #2.

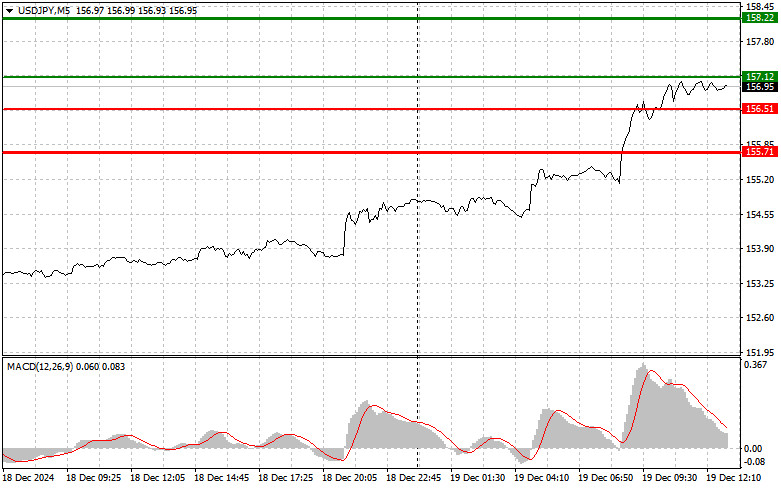

Scenario #1: Today, I plan to buy USD/JPY at 157.12 (green line on the chart), targeting a rise to 158.22 (thicker green line on the chart). At 158.22, I plan to exit my long positions and open short positions, expecting a retracement of 30–35 points from this level. A continuation of the uptrend is expected.Important! Before buying, ensure the MACD is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY after two consecutive tests of 156.51, with the MACD in the oversold zone. This will limit the pair's downward potential and prompt a reversal upward. Growth toward 157.12 and 158.22 is expected.

Scenario #1: I plan to sell USD/JPY after breaking below 156.51 (red line on the chart), targeting a decline to 155.71. At 155.71, I plan to exit short positions and immediately buy back the dollar, expecting a retracement of 20–25 points. Dollar pressure will likely return only after weak US data.Important! Before selling, ensure the MACD is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY after two consecutive tests of 157.12, with the MACD in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward 156.51 and 155.71 is expected.

Beginner Forex traders should approach market entry decisions with great caution. Before the release of key fundamental reports, it's best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you fail to manage risk and trade with large volumes.

Remember, successful trading requires a clear plan, like the one outlined above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.