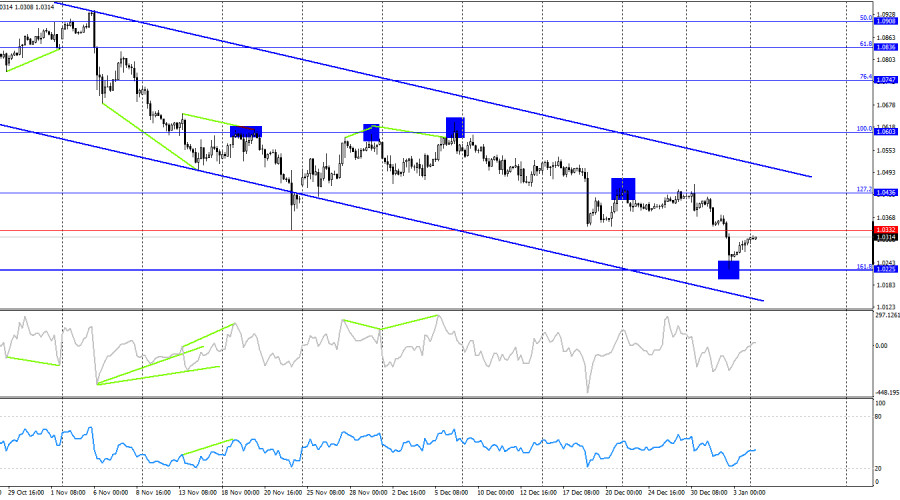

On Friday, the EUR/USD pair rebounded from the 127.2% corrective level at 1.0255, reversed in favor of the euro, and began rising toward the resistance zone of 1.0336–1.0346, a movement that is still ongoing. A price rebound from this zone will favor the U.S. dollar and lead to a new decline toward 1.0255. A sustained break above the 1.0336–1.0346 zone would indicate further growth toward the next resistance zone at 1.0405–1.0420.

The wave structure remains clear. The last completed upward wave failed to break the peak of the previous wave, while the most recent downward wave easily broke the previous low. This confirms the continuation of the bearish trend, with no signs of completion yet. For the trend to end, the euro must rise confidently above 1.0460.

Friday's news flow was quite weak as most of the world was still in holiday mode after Christmas and New Year's. Germany released unemployment reports showing no significant changes in December, while the U.S. ISM Services PMI came in at 49.3 points, exceeding expectations of 48.4. Despite this, bears refrained from further attacks. However, bearish positions remain dominant and well-supported. Below the 1.0336–1.0346 zone, bulls have little prospect for gains.

This week, several critical reports from the U.S., including labor market and unemployment data, will likely shape the market narrative through January. These are among the most influential reports for financial markets. Therefore, while bears are preparing for another attack, much will depend on this week's news flow.

On the 4-hour chart, the pair rebounded from the 161.8% corrective level at 1.0225 and began climbing toward 1.0332, which aligns with the resistance zone on the hourly chart. The downward trend channel clearly reflects the market's bearish sentiment, and until the pair breaks above it, significant euro growth is unlikely. A decline below 1.0225 appears more probable.

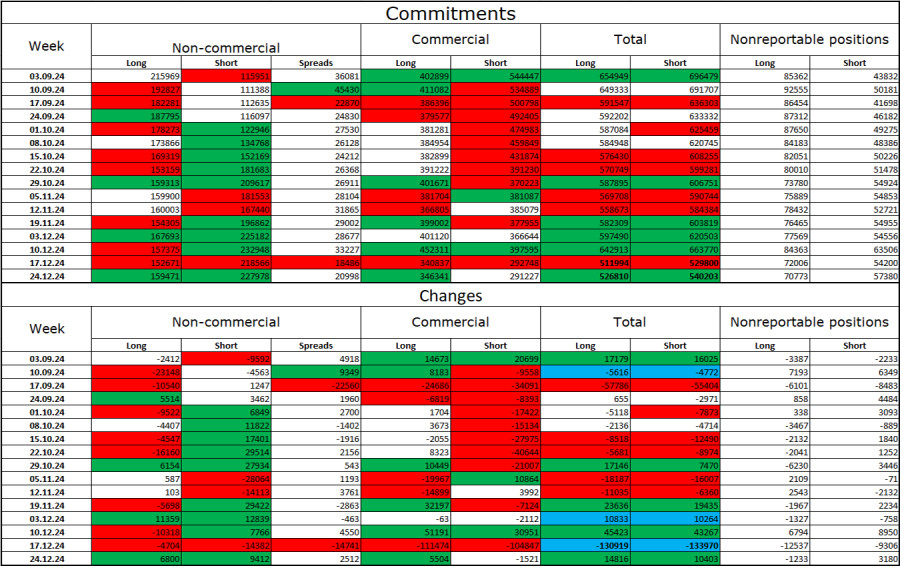

Commitments of Traders (COT) Report:

In the latest reporting week, speculators added 6,800 long positions and 9,412 short positions. The "Non-commercial" category remains bearish, indicating further potential declines for the pair. The total number of long positions now stands at 159,000, while short positions amount to 228,000.

For 15 consecutive weeks, major players have been shedding the euro, signaling a sustained bearish trend. While bulls occasionally dominate during certain weeks, this is more of an exception than the rule. The primary driver of dollar weakness—expectations of monetary easing by the FOMC—has already been priced in. Without new reasons to sell the dollar, its strength appears likely to continue. Technical analysis also points to the continuation of the long-term bearish trend. Therefore, I expect prolonged declines for the EUR/USD pair.

Economic Calendar for the U.S. and EU:

January 6 features two key events on the economic calendar, one of which is highly significant. However, the overall impact of the news flow on market sentiment today is expected to be moderate.

Forecast and Trading Recommendations for EUR/USD:

Fibonacci Levels: