At the close of yesterday's regular trading session, US stock indices ended with solid gains. The S&P 500 jumped by 9.52%, while the Nasdaq 100 surged by 12.15%. The industrial Dow Jones index climbed by 8.57%.

After five grueling days during which Donald Trump's trade war between the US and the rest of the world threw global equity and bond markets into turmoil, the US president backed down, pulling the financial system back from the brink.

The S&P 500 skyrocketed by nearly 10%, and the Nasdaq Composite posted its biggest jump since 2001. Short-term Treasury bonds fell, erasing previous gains, as investors scaled back expectations of interest rate cuts. The US dollar strengthened against traditional safe-haven currencies.

Market volatility was unprecedented. The VIX—Wall Street's famed "fear index"—posted its sharpest drop in history, while US Treasury bonds saw record swings. The sudden appetite for risk assets was triggered by Trump himself on Wednesday, when he unexpectedly announced a 90-day suspension of the punitive tariffs he had imposed on dozens of countries.

Before Trump's reversal, a brutal sell-off had wiped more than $10 trillion off global equity markets. Bond yields in developed economies—from the US to the UK and Australia—spiked sharply as investors frantically dumped them in favor of cash.

According to analysts, such dramatic market movements are usually seen only during crises, like the onset of the pandemic in 2020 or the financial chaos following the collapse of Bear Stearns and Lehman Brothers during the 2008 US housing crash. In this case, however, the turmoil was the result of an unpredictable US president attempting to unilaterally rewrite the rules of global trade. This undermined investor confidence and triggered concerns about the future.

The latest steps mark the end of a turbulent week that began when Trump shocked the world by announcing the highest US tariffs in a century, claiming they would bring back manufacturing jobs that had been offshored over the past few decades.

It's worth noting that the US president and his administration initially dismissed the market's reaction after last week's sharp sell-off, frustrating investors. But this week, as global market losses deepened, the situation reversed. Investors began dumping Treasuries and other government assets, pushing the yield on 30-year US bonds to its highest level since the start of the pandemic. This threatened to deal another blow to the global economy by raising the cost of all types of credit. It seems the Trump administration finally realized that the future of the global and US economies doesn't rest solely in their hands.

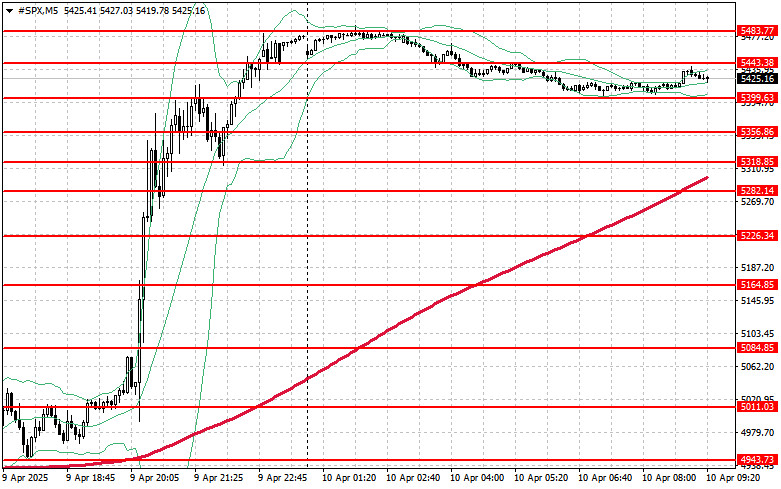

Technical picture of S&P 500

The S&P 500 index has bounced back. The main task for buyers today is to break through the nearest resistance at 5,444. A move above this level would signal continued growth and open the path toward the next target at 5,483. Just as important for the bulls is gaining control above 5,520, which would strengthen their position. If the market moves downward amid waning risk appetite, buyers must step in near 5,399. A breakdown below this support would quickly drag the index back to 5,356 and potentially open the door to a fall toward 5,318.