CoreWeave, startup v oblasti umělé inteligence podporovaný společností Nvidia (NASDAQ:NVDA), plánuje požádat investory, aby zaplatili 47 až 55 dolarů za každou jeho akcii, až tento týden začne prodávat svou primární nabídku akcií, uvedli ve středu lidé obeznámení s touto záležitostí.

Toto cenové rozpětí, které nebylo dříve oznámeno, by znamenalo nabídku 2,3 až 2,7 miliardy dolarů pro CoreWeave, uvedly zdroje, které si přály zůstat v anonymitě, protože jednání jsou důvěrná.

Společnost CoreWeave by mohla případně zvýšit toto rozpětí před cenou IPO, pokud by se ukázalo, že poptávka investorů je silná, uvedly zdroje.

Společnost CoreWeave na žádosti o komentář bezprostředně nereagovala.

Společnost CoreWeave, která byla založena v roce 2017, poskytuje přístup k datovým centrům a výkonným čipům pro pracovní zátěže umělé inteligence, které dodává především společnost Nvidia. Konkuruje poskytovatelům cloudových služeb, jako je Azure společnosti Microsoft (NASDAQ:MSFT) a AWS společnosti Amazon (NASDAQ:AMZN). Mezi její zákazníky patří velké technologické společnosti, jako jsou Meta (NASDAQ:META), IBM (NYSE:IBM) a Microsoft.

There are very few macroeconomic events scheduled for Tuesday. In the Eurozone and Germany, the second estimate of April's services PMI will be published, but these are unlikely to attract much attention. It's worth reiterating that last week, the market functioned just fine while ignoring an entire batch of macroeconomic data from the U.S. Therefore, these revised services indices in Europe are unlikely to generate any interest. The same applies to the equivalent index in the United Kingdom. As for the U.S., no significant events are on the calendar today.

There is still little sense in discussing fundamental events other than Trump's trade war, even though its escalation is paused. If Trump decides to impose new tariffs or increase existing ones, a renewed decline in the dollar could occur. Any escalation may trigger further dollar depreciation, while any de-escalation could support the currency. The U.S. president has recently softened his rhetoric toward China, but this is not yet a genuine de-escalation. Knowing Trump, it would not be surprising if he hikes tariffs again.

Trump understands that further tariff increases could harm the American economy, so we will likely not see any new aggressive actions from him soon. At the same time, there are still no trade negotiations with China underway, meaning the punitive 145%-125% tariffs remain in force. Last Wednesday, we saw how the U.S. economy responded to Trump's trade policies.

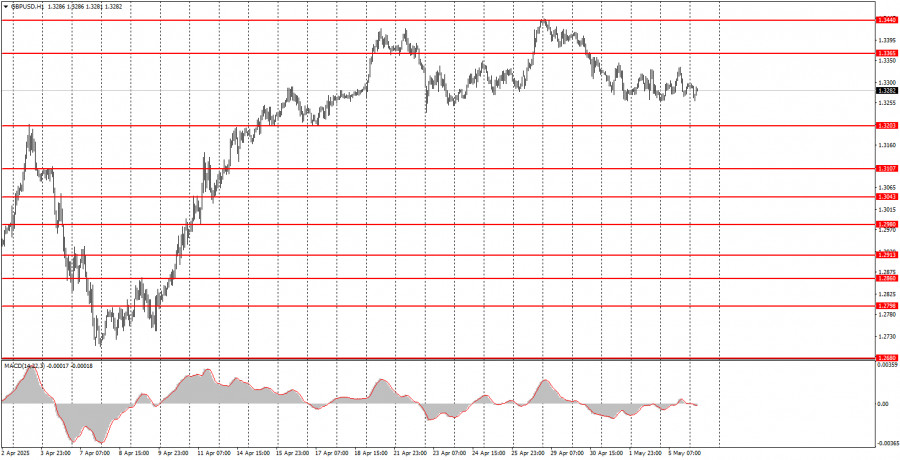

On the second trading day of the week, both currency pairs may move in either direction. EUR/USD may continue to trade sideways, and a bounce from the 1.1275 level could trigger a new upward swing. The British pound still strongly desires to rise but has declined for four consecutive days. The macroeconomic backdrop is expected to have no real influence on trader sentiment. Trading decisions can rely only on technical levels, which, unfortunately, often fail to deliver as expected.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.