Společnost Howmet Aerospace, která dodává díly pro letadla vyráběná společnostmi Airbus a Boeing, může podle dopisu, který viděla agentura Reuters, zastavit některé dodávky, pokud je ovlivní cla vyhlášená americkým prezidentem Donaldem Trumpem.

Společnost Howmet se sídlem v Pittsburghu v dopise zákazníkům uvedla, že vyhlásila zásah vyšší moci, což je právní postup, který umožňuje smluvním stranám vyhnout se svým závazkům, pokud je zasáhnou nevyhnutelné a nepředvídatelné vnější okolnosti.

„Společnost Howmet bude omluvena z dodávek jakýchkoli výrobků nebo služeb, které jsou ovlivněny tímto vyhlášeným stavem národní nouze a/nebo nařízením o clech,“ napsala společnost Howmet v dopise.

The U.S. labor market data, published by the Department of Labor, instilled cautious optimism among investors, extending the rally in U.S. equity markets, supporting the dollar, and weakening gold prices.

According to the released employment report, the U.S. economy added 147,000 new jobs in the nonfarm sector in June, compared to the forecasted drop to 111,000. Importantly, the May figures were revised upward to 144,000. A pleasant surprise also came from the drop in the unemployment rate, from 4.2% to 4.1%, which was lower than the expected increase to 4.3%.

The data was interpreted positively by investors, which led to increased demand for stocks and pushed up the three main U.S. stock indices. All of this occurred during a shortened trading day ahead of Independence Day, a period when trading volumes are usually low and market participant activity is subdued.

Also worth noting in the context of positive news are the figures for average hourly earnings and the average workweek in the U.S. These indicators showed declines, which might be seen as negative in other circumstances. However, amid concerns of potential inflation rising against a backdrop of high demand for goods and services, this trend can be seen as a sign of inflation slowing. This, in turn, supports expectations that the Federal Reserve might cut the key interest rate by 0.25% in September.

Today is a public holiday in the U.S. Market activity worldwide is noticeably lower than usual, as many American investors are absent due to the long weekend.

Trading is likely to be sluggish, with minimal price changes. Starting Monday, market participants are expected to return more actively, responding to the labor market report, as well as progress in negotiations between the U.S. and Vietnam on mutual trade, and the White House's decision to lift restrictions on software exports to China. In addition, focus will be on the final approval by Congress of President Donald Trump's $3.4 trillion tax and budget plan. All these developments are viewed as positive for the stock market.

The cryptocurrency is trading in a sideways range of 82.00–91.00 amid continued high uncertainty about the future of the dollar and the global economy. Against this backdrop, the price fell below the support level of 88.75 and may continue to decline toward the lower boundary of 82.00. The 87.35 level may serve as a signal to sell.

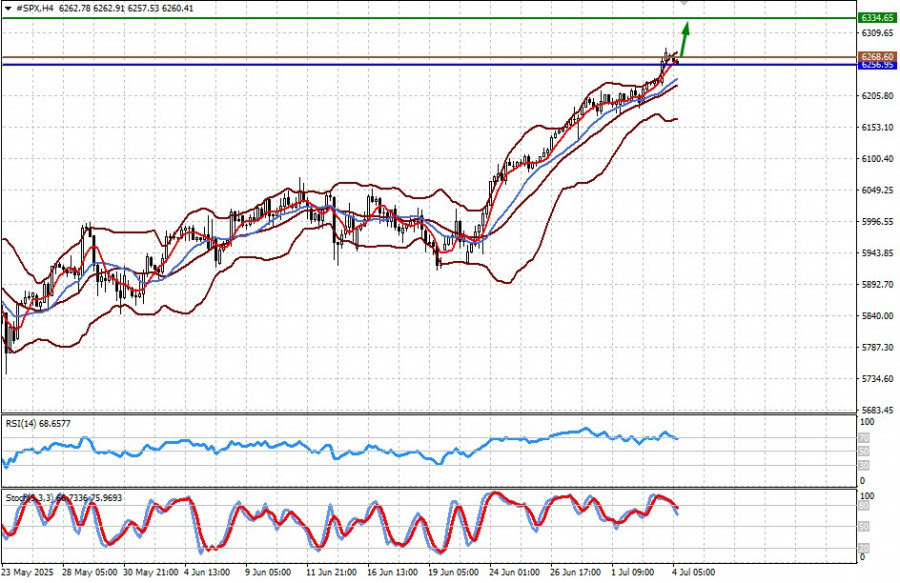

The CFD contract on the S&P 500 futures is undergoing a mild downward correction due to the U.S. holiday. It may fall toward the support level of 6249.60, and then, after rebounding from that level, resume its upward trend next week. The 6268.60 mark is a potential buying level.