New York – Spotřebitelská důvěra ve Spojených státech v dubnu čtvrtý měsíc za sebou klesla. Stupňující se celní válka, kterou rozpoutal americký prezident Donald Trump, zvyšuje obavy amerických domácností ohledně pracovních míst a růstu cen. Inflační očekávání spotřebitelů na příštích 12 měsíců jsou teď nejvyšší od roku 1981, ukázaly dnes předběžné výsledky průzkumu Michiganské univerzity.

An unexpected announcement from Donald Trump that the U.S. has struck a "major deal" with Japan gave investors a sense of relief, fueling demand for company stocks and reducing overall market tension.

On Tuesday, the U.S. president cheerfully posted on his social network, Truth Social, that the U.S. had signed "possibly the biggest deal ever made" between the U.S. and Japan. The new trade agreement includes a 15% tariff on goods imported from Japan. He also stated that Japan would invest 550 billion dollars in the U.S. economy and open its markets to key American goods. Treasury Secretary S. Bessent expressed cautious optimism, signaling that the current tariff truce with China would likely be extended beyond its August 12 expiration.

This news is, in fact, Trump's first personally significant achievement, indicating that his pressure tactics on trade partners are working. It is a significant development, as it softens the negative outlook caused by the reduced likelihood of deals with economic giants like China and India, which have been unresponsive to U.S. threats — including those from Trump himself.

Why did Japan yield to the U.S.?

Unlike China or India, Japan is effectively a U.S. satellite, both politically and economically, so the signing of an unfavorable trade agreement was only a matter of time. The same applies to Canada, Mexico, and, eventually, to the EU, regardless of current resistance. One could argue that all of Washington's satellites will, sooner or later, after some resistance, give in to Trump and sign deals detrimental to their own economies, effectively paying a loyalty rent to the hegemon.

How will the news from Japan affect the markets?

It is already having a positive impact on Asian stock markets and is boosting stock futures in Europe and the U.S. As mentioned above, this news gives market participants hope that the tariff saga may come to a close in the foreseeable future. Although the pressure will remain for China, India, and possibly other nations, the current wave of triumphalism may overshadow that negativity.

What to expect in markets today?

Stocks are likely to be in the highest demand. Reduced geopolitical tension is expected to support the U.S. dollar, which had previously suffered due to Trump's economic and geopolitical initiatives. The main supporting factor for the dollar remains the uncertainty around the timing of the next Fed rate cuts. On this wave, the U.S. Dollar Index may rise toward the 98.00 mark.

The token is showing signs of a local reversal due to a potential strengthening of the dollar in the Forex market and easing tensions following the U.S.-Japan tariff deal. In this context, Ethereum may correct down to 3,462.65 after falling below the 3,639.65 support level. A possible sell trigger could be the 3,610.17 mark.

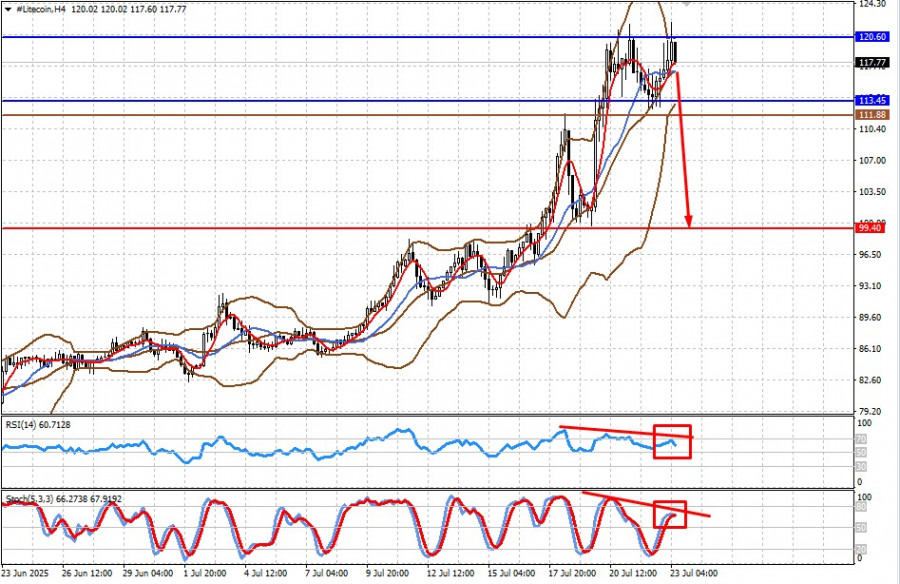

Litecoin is also showing a local reversal amid a potential rise in the dollar and easing tensions driven by the U.S.-Japan trade agreement. Against this backdrop, it could correct down to 99.40 after breaking below the 113.45 support level. A possible sell level could be at 111.88.