The U.S. president is fully implementing his aggressive policy toward everyone and everything — both in foreign and domestic affairs. While his actions toward trade partners are more or less clear by now, the escalation of the crisis with the Federal Reserve appears to be gaining momentum.

The U.S. president has repeatedly urged Jerome Powell to lower interest rates, citing the need to stimulate growth in the national economy and the real production sector. However, the Fed Chair, adhering to the 2% inflation rule (established back in the late 20th century, mainly by coincidence), has held his ground, arguing that the current inflation level and uncertainty over the consequences of the trade war make such a move unjustified.

This has led to a classic standoff. Trump previously secured congressional approval to increase the national debt to stimulate domestic production, and now he seeks to reduce borrowing costs by pushing for lower interest rates. In this context, the president's sudden criticism of the Fed and its chair appears rather calculated.

If Powell were more compliant, Trump likely wouldn't have drawn attention to the grand-scale renovation of the Fed's building, estimated at around 3.1 billion dollars. These "unjustified expenses" have now become a convenient pretext for exerting pressure on the Fed Chair. In essence, Trump is reverting to one of his favorite tactics: using pressure and blackmail to achieve personal goals.

Given the president's nature and persistence, it's quite likely that a compromise will be reached. Rates will be cut. Of course, this won't happen immediately — probably not at next week's meeting — but the likelihood could rise significantly in August or September. And the current year-over-year inflation rate of 2.7% won't necessarily prevent it.

The primary beneficiary would likely be the U.S. stock market, which is already buoyed by an influx of foreign capital seeking safe investment opportunities. Lower borrowing costs would only fuel further gains and drive stock prices to new highs.

At the same time, growing expectations of a rate cut would likely hit the dollar's exchange rate, which, despite Trump's patriotic rhetoric, would benefit U.S. producers. A weaker dollar would help them better compete globally, offsetting high labor costs.

I believe that anticipation of a tariff agreement with the EU, which would naturally favor the U.S., will support demand for equities. U.S. stock index futures are rising confidently in anticipation of these expectations.

This shift in focus toward equities may put pressure on the cryptocurrency market, prompting further declines in token values relative to the dollar. The oil market is also responding positively, as one source of uncertainty may soon be removed.

The token is under significant pressure due to rising demand for U.S. equities. It has dropped below 115,700.75, which could further reinforce the downward trend and push it toward 111,600.00. A potential sell level is 115,015.00.

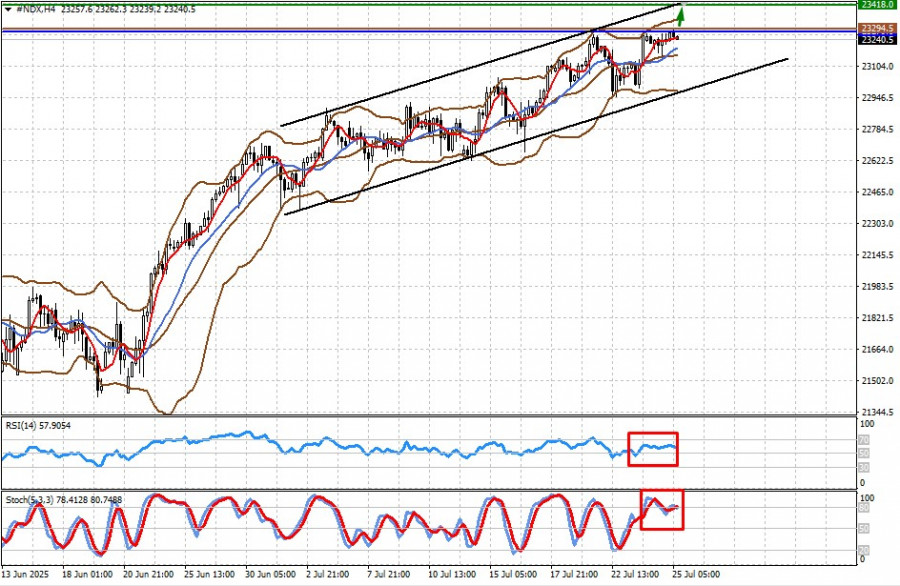

The CFD on the NASDAQ 100 futures contract is currently trading below the resistance level of 23,279.00. A breakout above this level could fuel another upward push toward 23,418.00. A potential buy level is 23,294.50.