If you knew where you'd fall, you'd lay down some straw. If the Federal Reserve had known about the serious cooling in the U.S. labor market, it would have cut rates in July — perhaps even in June. Now it will have to accelerate the pace of monetary easing. This is the view of Scott Bessent, who proposes lowering borrowing costs by 50 bps in September and by 150 bps over the following FOMC meetings. The Treasury Secretary is acting as the White House's spokesperson, and his dovish rhetoric is allowing EUR/USD buyers to challenge the key 1.17 resistance level.

Following the July U.S. inflation data, the futures market is 99.9% certain of a federal funds rate cut in September. Given that the European Central Bank, according to Bloomberg experts, is not expected to resume its rate-cut cycle until December — and will likely end it there — the divergence plays in favor of EUR/USD bulls. And that's not their only advantage.

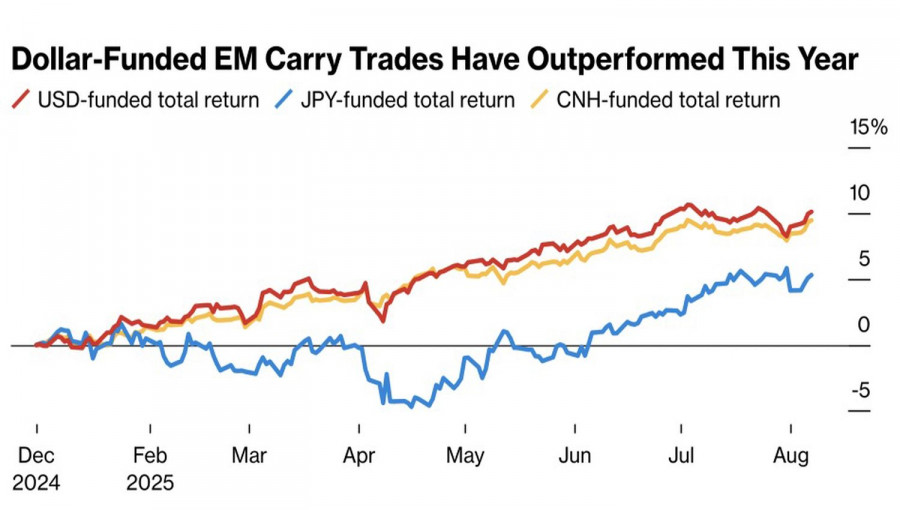

After the United States signed trade agreements with its partners, uncertainty around the White House's tariff policy has sharply declined. Financial market volatility has dropped, and in Forex, it has fallen to its lowest level in more than a year. This trend opens the door to carry trade operations — and the U.S. dollar is suffering as a result.

The fact is, the greenback is increasingly being used as a funding currency. The effectiveness of carry trades involving the dollar and emerging market currencies now exceeds similar operations with the yen or the Chinese yuan.

Although recession risks in the U.S. economy have receded, stagflation remains a concern. Slowing GDP growth amid still-high prices is not an environment in which the dollar has historically thrived — especially with trust in Fed policy eroding. This is prompting capital outflows from North America to Europe and supporting EUR/USD's upward movement.

Adding fuel to the fire is the increase by foreign investors in currency risk hedging for U.S. asset holdings, as well as the creation of financial safety cushions by other countries. While the Fed has paused its monetary easing cycle, the ECB has been actively cutting rates. While the U.S. pursued fiscal consolidation, Germany opened its wallet. These stimulus measures will likely have a positive effect on economic growth outside the United States in the future, providing further support to the main currency pair.

The only real threat could be an unsuccessful U.S.-Russia presidential summit in Alaska, but even that is unlikely to break the bullish trend.

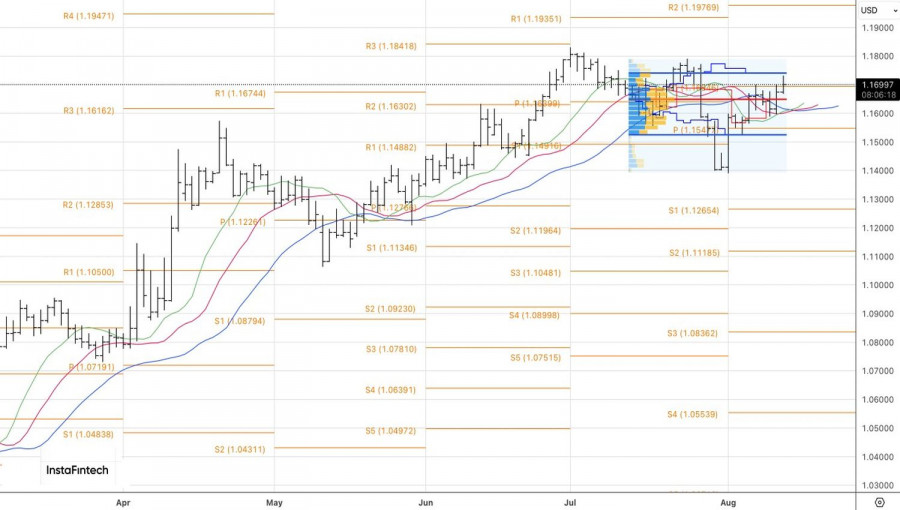

On the daily EUR/USD chart, the pair is currently testing the pivot level at 1.1700. Only a breakout toward the upper boundary of the fair value range at 1.1525–1.1745 would signal a trend recovery. A failed breakout would keep the euro in its trading range. Adding to long positions from the 1.155 and 1.165 levels remains relevant.