The test of the 147.17 price level occurred when the MACD indicator had already moved far down from the zero mark, which limited the pair's downside potential. For this reason, I did not sell the dollar. The second test of 147.17 took place when the MACD was in the oversold area, allowing the implementation of Buy Scenario No. 2 and resulting in a 30-point rise in the pair.

This morning, the yen outperformed all major currencies after U.S. Treasury Secretary Scott Bessent made comments suggesting that the Federal Reserve and the Bank of Japan would adjust their interest rates. The Japanese currency strengthened by 0.7%, reaching 146.38 per dollar. This came after Bessent called on the Fed to cut rates by 150 basis points or more and stated that the Bank of Japan was lagging in its fight against inflation, thereby hinting at the need for rate hikes.

The market instantly took the Treasury Secretary's remarks as a signal of potential changes in the monetary policies of both countries. Investors, who had previously been uncertain about the Fed's and BOJ's next moves, seized on Bessent's statement as a cue, triggering mass yen buying after the currency had recently been heavily oversold. The prospect of simultaneous interest rate adjustments by the world's two largest economies created a domino effect in financial markets. Expectations that the Fed might ease its tight policy while the BOJ could abandon its ultra-loose stance led to asset reallocation and increased volatility.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

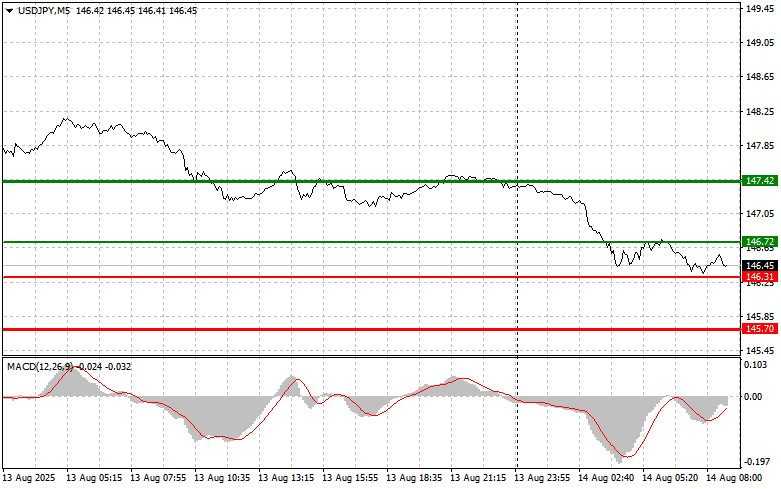

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 146.72 (green line on the chart) with a target of rising to 147.42 (thicker green line on the chart). Around 147.42, I plan to close long positions and open short positions in the opposite direction (aiming for a 30–35-point move in the opposite direction from the level). It is best to return to buying the pair during pullbacks and significant USD/JPY declines. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 146.31 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected toward the opposite levels of 146.72 and 147.42.

Scenario No. 1: I plan to sell USD/JPY today only after breaking below the 146.31 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 145.70, where I plan to close short positions and immediately open long positions in the opposite direction (aiming for a 20–25-point move in the opposite direction from the level). It is better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to move down from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 146.72 price level when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a downward market reversal. A decline can be expected toward the opposite levels of 146.31 and 145.70.