The EUR/USD currency pair continued trading in a complete flat with low volatility on Wednesday. Many experts point to obvious reasons for such market behavior this week. However, many of them also constantly refer to Jerome Powell's upcoming speech on Friday, suggesting that markets are waiting for this event to make a move and open new positions. We believe this is an entirely mistaken view.

Over the past six months, or even a year, it seems as though everything now revolves around Powell. It feels as if Donald Trump is the Ruler of the World, while Powell is the Head of the Global Financial System. Everyone is constantly talking about the Federal Reserve's rates, and markets are endlessly expecting monetary policy easing. The next Fed Chair speech is awaited as if the dollar's fate depends solely on it.

Let's recall that in the first half of 2025, the Fed kept its rate at 4.5% — a relatively hawkish level. And yet, throughout that period, the dollar steadily fell against both major and minor currencies. In other words, the Fed's monetary policy and, even more so, Powell's rhetoric, did not influence the U.S. currency. Why? Because Trump's trade war has carried and still carries far greater weight.

Moving on. Powell and his colleagues have never indicated the scale of rate cuts that the market has been expecting. Simply put, market expectations for Fed monetary easing were exaggerated back in 2024, and in 2025 they remain so. Even now, traders expect the Fed to rush to rescue the labor market by cutting the key rate at every meeting. Or perhaps Trump will ultimately pressure the Fed into cutting rates the way he wants. Maybe that will happen, but if it does, it will not be before 2026, when Powell steps down and Trump replaces several more unwanted FOMC members.

It is also worth remembering Powell's character. He is now 72 years old, clearly a cautious person, and has been at the helm of the world's key financial institution since 2018 — a full seven years. Does anyone really believe that Powell will step up to the podium on Friday and openly announce a September rate cut? Of course, there could be some hints or a very slight, almost imperceptible, shift in rhetoric. But as practice shows, the market often invents things that are not there.

We believe Powell will not surprise markets on Friday. His speech will be as bland and cautious as possible. Ahead lies another inflation report and another set of labor market data. Why would Powell rush with promises or even hints? And in any case, his speech at Jackson Hole will take place in the evening. Even if unexpected information comes out, who would want to open trades before the weekend? For us, Powell's speech is simply an event of interest that should not be ignored, but not one to trade on.

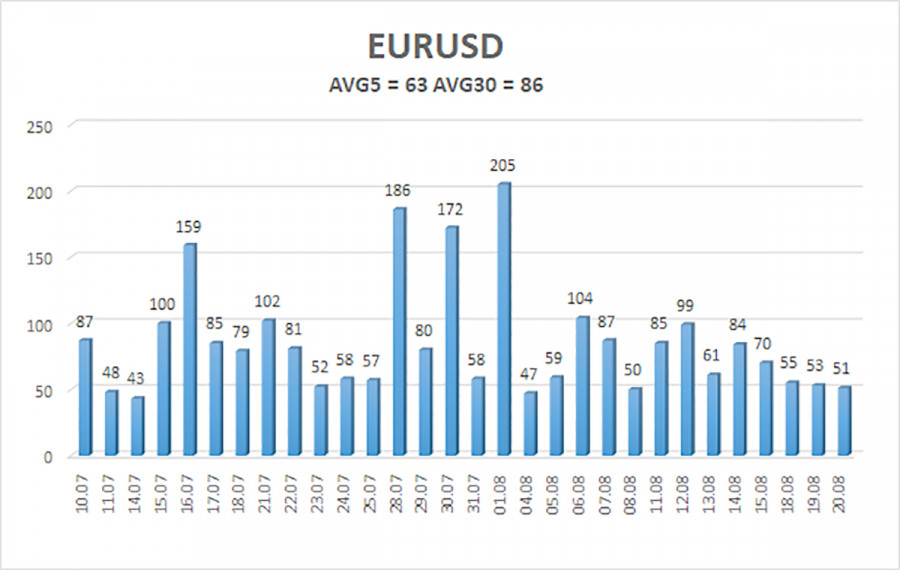

The average volatility of the EUR/USD currency pair over the last five trading days, as of August 21, is 63 pips, classified as "moderate." We expect the pair to move between levels 1.1597 and 1.1723 on Thursday. The long-term linear regression channel is pointing upward, still indicating an uptrend. The CCI indicator has entered the oversold zone three times, which warns of the resumption of the upward trend.

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

The EUR/USD pair may resume its upward trend. Trump's policies continue to exert the strongest pressure on the U.S. currency, and he has no intention of "stopping where he is." The dollar rose as much as it could, but now it seems the time has come for a new round of prolonged decline. If the price stays below the moving average, short positions with targets at 1.1597 and 1.1536 can be considered. Above the moving average, long positions remain relevant with targets at 1.1719 and 1.1780, in continuation of the trend. In recent days, the market has been completely flat.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.