Americké akcie se v pondělí obchodovaly výrazně níže, když investoři vyhodnocovali dopad celních plánů prezidenta Donalda Trumpa a posuzovali jeho jízlivé výroky na adresu předsedy Federálního rezervního systému Jeroma Powella.

Do 16:51 SELČ se benchmark S&P 500 propadl o 119 bodů, tedy o 2,3 %, technologický Nasdaq Composite ztratil 437 bodů, tedy 2,7 %, a blue-chip Dow Jones Industrial Average ustoupil o 851 bodů, tedy o 2,2 %.

Hlavní indexy na Wall Street byly v pátek zavřené, zatímco na některých trzích, včetně velké části Evropy, byly na Velikonoční pondělí prázdniny, což znamená, že likvidita byla poměrně nízká.

„[Je velmi pravděpodobné, že 2. duben byl pro cla vrcholem a plně očekáváme, že probíhající jednání přinesou „dohody“, které sníží celní zátěž,“ uvedli analytici společnosti Vital Knowledge s odkazem na datum, kdy Trump odhalil svá rozsáhlá reciproční cla jak na přátele, tak na nepřátele.

A considerable number of macroeconomic reports are scheduled for Thursday, so throughout the day, the data will exert a steady influence on movements in the foreign exchange market. However, this influence is unlikely to be strong. Business activity indices in Germany, the EU, the UK, and the U.S. are certainly interesting, but not the most important indicators. Moreover, for these reports, the key factor is the ratio of the actual value to the forecast. If the deviation is minimal or absent, then the market reaction will also be absent. Today, traders may react to the published data not because the reports are significant, but because there are simply no other releases this week. The U.S. will also publish reports on jobless claims and new home sales, which are even less important than the business activity indices.

Among Thursday's fundamental events, the speech by Federal Reserve representative Raphael Bostic can be noted. Recall that the market sees the Fed as moving quickly toward a key rate cut in September. However, traders will likely draw conclusions tomorrow, after Jerome Powell's speech at Jackson Hole. Thus, Bostic's remarks today are expected to go largely unnoticed.

The trade war remains the number one focus for traders. Since we see no signs of de-escalation, there are no grounds for the market to engage in medium-term dollar buying. As before, the U.S. currency may rely only on local growth based on technical factors or individual events/reports, but nothing more.

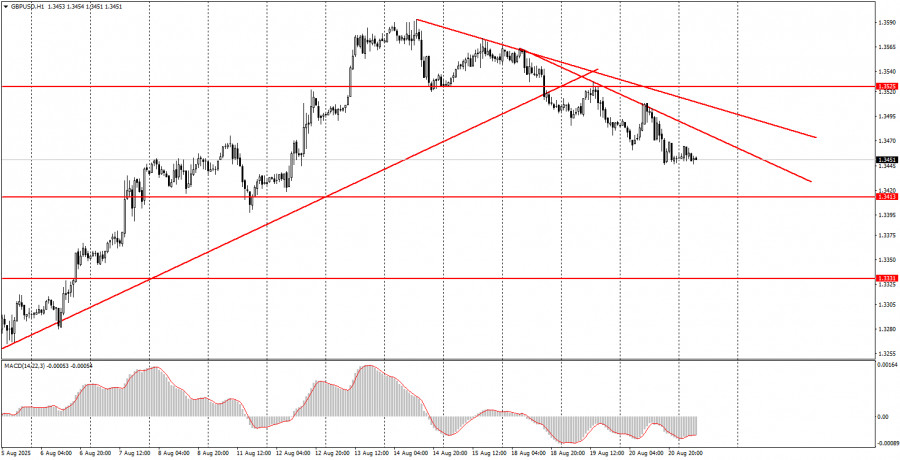

On the fourth trading day of the week, both currency pairs may trade in either direction, since fundamentals and macroeconomics will once again be weak today. The euro may continue its sluggish decline after breaking through the 1.1655–1.1666 area, while the British pound can be traded from the 1.3466–1.3475 area.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.