The EUR/USD currency pair on Thursday once again traded with minimal volatility and a complete unwillingness to move in any direction. While in the first three trading days of the week, there were practically no macroeconomic or fundamental events, reports began to be published on Thursday. Thus, we see that the market has no desire to react to secondary indicators, no desire to buy the dollar even when there are certain grounds for it. This is because the same global factors we have been discussing for several months remain in play: the trade war, Donald Trump's policies, pressure on the Federal Reserve, and the Bureau of Labor Statistics. But let's go step by step.

In this article, we will not cover macroeconomic reports — they are discussed in other articles. Instead, we will focus on the Fed minutes, which contained one very important detail. Let us recall that Fed minutes are formal documents that usually contain no interesting information. Moreover, they reflect the sentiment of the monetary committee members as of the date of the meeting. The minutes themselves are published two weeks later. In most cases, important reports on the U.S. economy come out during those two weeks — and voila! — The minutes no longer matter because they are outdated.

However, this week the Fed minutes answered (or tried to answer) one very important question: what is more important for the U.S. central bank — inflation or the labor market? To briefly recap: inflation in the U.S. has been accelerating for the past three months, and most experts believe this is just the beginning, since Trump's tariffs have not even shown their full effect yet (by about 20%). At the same time, the U.S. labor market has been declining for three months in a row. To contain inflation, the key rate cannot be cut. To prevent a further decline in the labor market, the key rate needs to be cut. And this is the question: what will the Fed choose?

The FOMC minutes showed that most officials see the risks of high inflation as outweighing the risks of a labor market slowdown. In other words, price stability remains the Fed's top priority. Of course, the labor market could slow down even more, some "hawks" could turn into "doves," and Donald Trump could force a few more committee members into resignation, as was the case with Adriana Kugler. Then the labor market would move to the top priority, and monetary policy would need to be eased.

Thus, the Fed minutes, on the one hand, indicated that the central bank may continue to follow a hawkish policy, but on the other hand, gave no clear answer to the rate question. Jerome Powell today will have to put the dots on the i's, because, as we said, the minutes are published with a two-week delay, during which much can change. The market did not react to the minutes at all, unless one tries to extract a 20-pip move from the charts. In general, we must wait for Powell's speech, but even that may not provide an answer to the question of what the Fed intends to do on September 17.

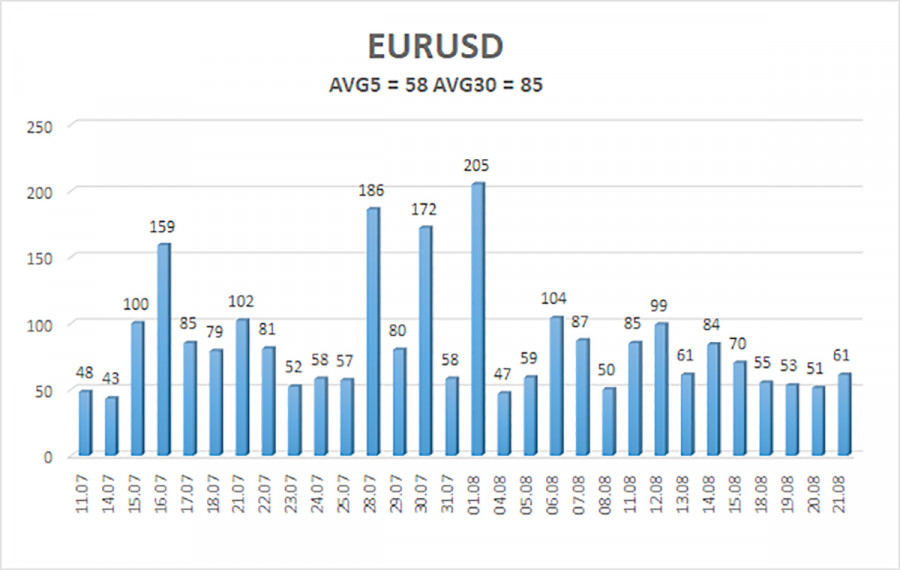

The average volatility of the EUR/USD currency pair over the past five trading days as of August 22 is 58 pips and is characterized as "medium-low." We expect the pair to move between the levels of 1.1552 and 1.1668 on Friday. The long-term linear regression channel is pointing upward, which still indicates an uptrend. The CCI indicator has entered the oversold area three times, signaling the resumption of the upward trend.

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

The EUR/USD pair may resume its upward trend. The U.S. currency is still under intense pressure from Trump's policies, and he has no intention of "stopping where he is." The dollar has risen as much as it could, but now it seems time for another round of prolonged decline. If the price is below the moving average, small short positions with targets at 1.1597 and 1.1552 can be considered. Above the moving average, long positions with targets at 1.1719 and 1.1780 remain relevant in continuation of the trend. In recent days, the market has formed a flat.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.