Yesterday, US stock indices closed higher. The S&P 500 rose by 0.85%, while the Nasdaq 100 added 0.72%. The Dow Jones Industrial Average fell by 1.36%.

Relatively moderate inflation readings, combined with new signs of weakening employment, triggered a rally on Wall Street amid speculation that the Federal Reserve will cut interest rates for the first time this year.

The long-awaited consumer price index showed that although inflation still exceeds the Fed's 2% target, it remains under control. At the same time, weekly jobless claims surged to their highest level in nearly four years, reinforcing bets on a rate cut next week to counter the rapid slowdown in the labor market.

This mixed picture created a complex challenge for the Federal Reserve, which is trying to balance the risks of easing too quickly versus too slowly. On the one hand, sticky inflation calls for caution and keeping interest rates elevated to prevent further price acceleration. On the other hand, signs of economic weakness and rising unemployment point to the need for stimulus to avoid a recession.

In this environment, the Fed is likely to act gradually, closely monitoring incoming data and adjusting policy as economic conditions evolve. The regulator is expected to cut interest rates by 0.25% at next week's meeting to support the economy, while leaving the door open for further adjustments depending on inflation and employment trends.

All this has sparked active buying in equity markets. It was also enough to lift Treasury bonds, with 10-year yields briefly topping 4%. Major US stock indices hit record highs. Gold also moved closer to its historical peak. Energy stocks fell in line with oil.

Against this backdrop, expectations of rate cuts have increased across Wall Street.

"It's clear that inflation is relatively calm, which gives the Fed the flexibility to focus more on stemming ongoing weakness in the labour market," Regan Capital said. "We expect the Fed to cut 25 basis points next week and to follow through with another two 25-basis-point cuts this year."

"Right now, inflation is a key subplot, but the labour market is still the main story," Morgan Stanley Wealth Management noted. "Today's CPI may appear to offset yesterday's producer price index, but it wasn't hot enough to distract the Fed from the softening jobs picture. That translates into a rate cut next week — and, likely, more to come."

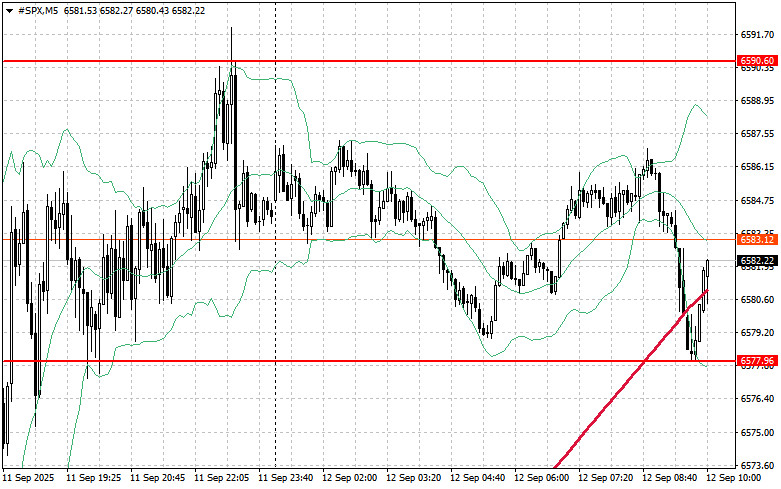

As for the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,590. This will support further gains and open the way for a push to $6,603. Equally important for bulls will be holding control above the $6,616 level, which would strengthen buyers' positions. In case of a downside move amid weaker risk appetite, buyers must assert themselves near $6,577. A breakout below this mark would quickly push the index back to $6,563 and open the road to $6,552.