The EUR/USD currency pair exhibited a downward movement on the third trading day of the week. However, overall behavior has remained consistent — this is still a gradual upward trend on the lower timeframes. On the 4-hour chart, the euro has been rising steadily for the past month and a half, indicating no fundamental change in price behavior. The euro still tends toward growth, but it's a slow grind. Why? It's challenging to answer definitively, but we can assume the initial wave of panic associated with Donald Trump's policies has passed. From here, the euro may climb more calmly — unless, of course, a sudden shock sends the dollar into another tailspin.

Yesterday, like other days this week, the dollar offered nothing but trouble. And what else could be expected under the current circumstances? Wednesday marked the first day of the government shutdown, and no one knows how long it will last. Of course, a shutdown is not the same as a total economic halt like we saw during the pandemic, but it does involve the closure of many federal institutions. Workers will either be laid off or sent on unpaid leave. Will these Americans — perhaps as many as one million — continue to spend as they usually do? No, they will start cutting back. Many private-sector companies that rely on government contracts will also suffer as a result. In short, the U.S. economy will absolutely be impacted by the shutdown. The only question is: how severely?

Meanwhile, the eurozone released its September inflation report. The day before, Germany had reported higher-than-expected inflation, which raised expectations for a stronger euro area number — but those hopes were quickly dashed. Headline inflation came in at 2.2%, and core inflation at 2.3%, exactly in line with forecasts. The euro declined mainly because inflation rose only modestly — although, in our view, it wasn't supposed to rise in the first place, especially after the European Central Bank spent years trying to suppress it.

Yet the market was disappointed by "low" inflation because it suggests that the ECB won't be moving to tighten monetary policy anytime soon. That's the key point: If inflation were climbing like in the U.S. or the U.K., the ECB might be forced to consider raising interest rates again — something it had been reducing aggressively over the past 12–15 months. Although this seems improbable at this point, we'd argue it shouldn't be ruled out entirely. It's also worth noting that while the euro fell, the British pound held steady, which further confirms that the inflation data was responsible for the euro's weakness.

Overall, the market remains unresponsive to most major events currently unfolding in the U.S. and Europe. Volatility is still relatively low, and the pair's movement is flat on virtually all timeframes. The shutdown has not (yet) had any noticeable impact on the dollar's exchange rate.

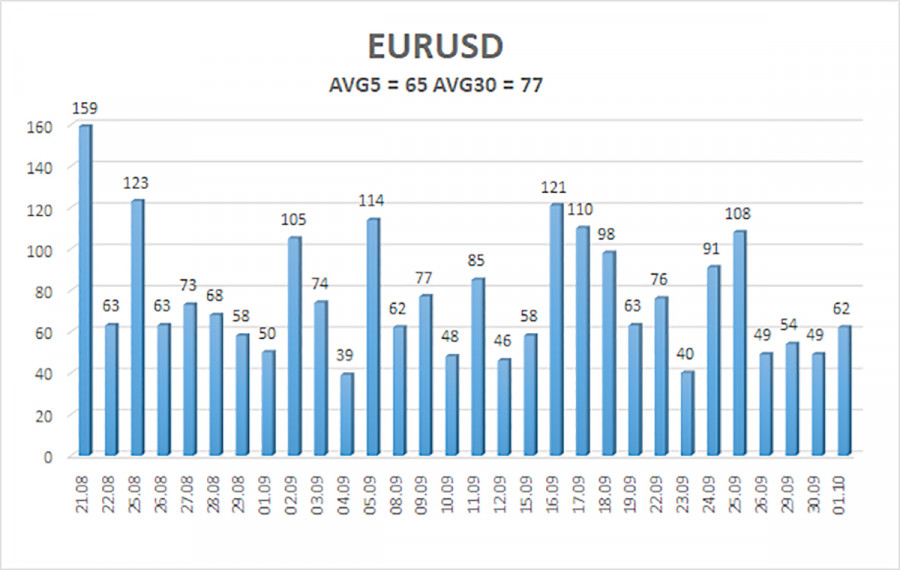

As of October 2, the average volatility for EUR/USD over the last five trading days sits at 65 pips — considered "moderate." We expect the pair to move between levels 1.1657 and 1.1797 on Thursday. The longer-term linear regression channel points upward, indicating that the broader uptrend remains in effect. The CCI indicator entered overbought territory, triggering the current phase of downward correction.

The EUR/USD is currently undergoing a correction, but the broader upward trend remains intact across all timeframes. The U.S. dollar remains heavily influenced by Donald Trump's policies — and he doesn't appear to be backing down. The dollar has gained as much as it can over the past month and now seems to be poised for a new leg of extended weakening.

If the price remains below the moving average, traders may consider taking short positions with targets at 1.1667 and 1.1597, based solely on technical signals. If the price rises above the moving average, long positions remain relevant with targets at 1.1841 and 1.1902 in line with the existing trend.