Only the Australian dollar could be traded today using the Mean Reversion strategy. The Japanese yen once again performed well with trades through Momentum.

The PMI activity data from the Eurozone and the U.K. came in slightly below economists' forecasts, but this had little impact on the FX market and traders. Moreover, although inflationary pressure has eased somewhat in recent months, it still remains a source of uncertainty. The European Central Bank continues to pursue a wait-and-see policy, which supports the euro. The Bank of England is acting in a similar way, hoping to bring inflation fully under control in the coming quarters.

In the second half of the day, the focus will shift to the ISM Services PMI and the composite PMI for September. In addition, FOMC member John Williams will deliver a speech.

Traders will closely monitor these releases, as they provide insight into the current state of the U.S. economy. The ISM Services Index, in particular, is considered a key indicator of consumer demand and overall economic activity. Better-than-expected results could push the dollar higher and trigger sell-offs in the euro, pound, and other risk assets. The Composite PMI, which combines manufacturing and services data, will offer a broader picture of the economy. John Williams' comments on inflation prospects and the Fed's future monetary policy course will also draw significant attention. His remarks could cause considerable volatility in financial markets, potentially strengthening the dollar—similar to what we saw yesterday.

If the data come in strong, I will rely on the Momentum strategy. If the market reaction is muted, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout Trades) for the Second Half of the Day:

EUR/USD

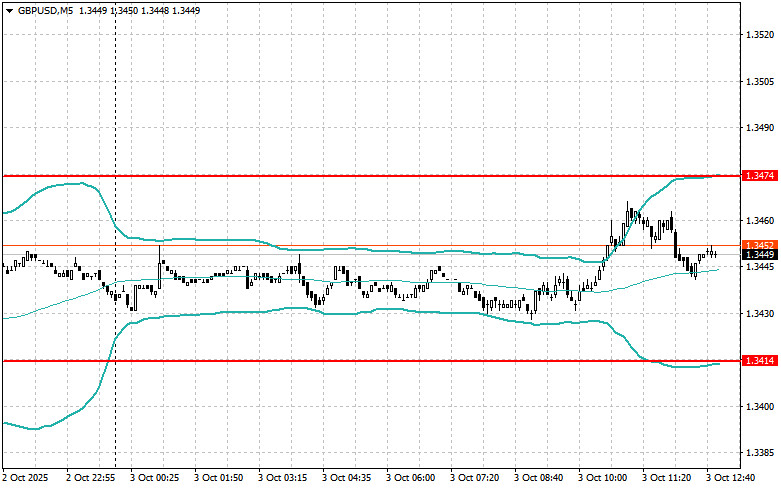

GBP/USD

USD/JPY

Mean Reversion Strategy (Reversal Trades) for the Second Half of the Day:

EUR/USD

GBP/USD

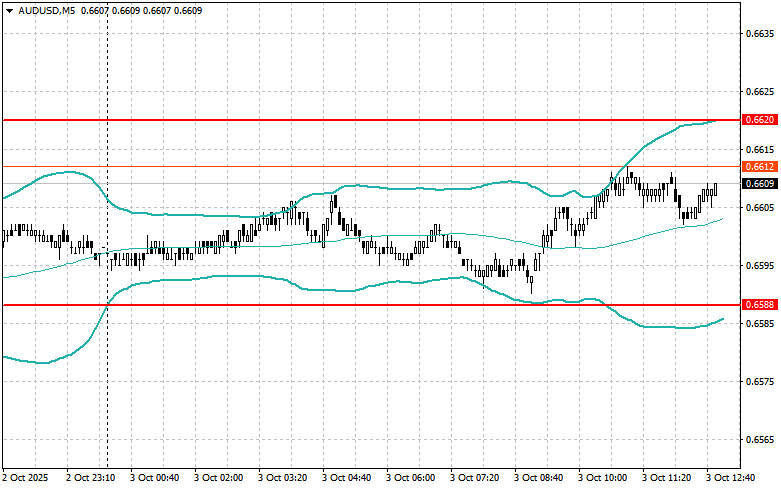

AUD/USD

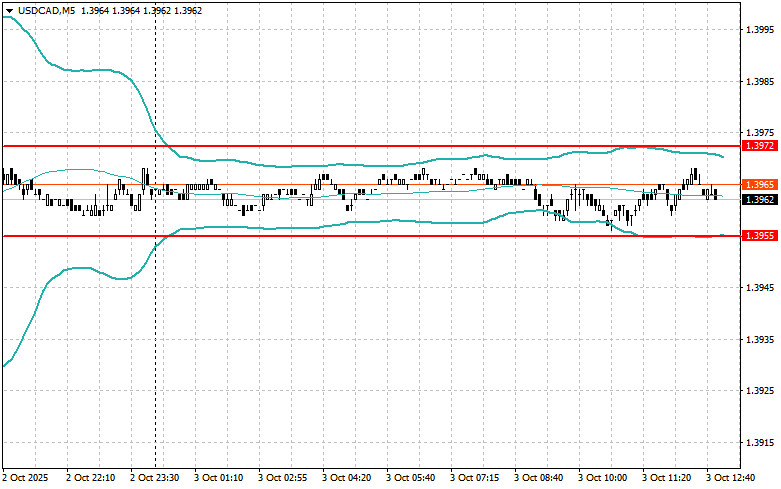

USD/CAD