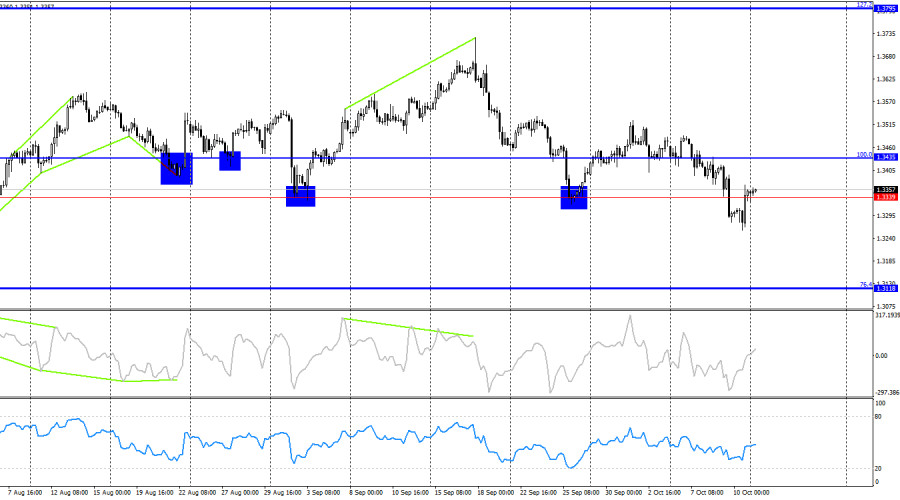

On the hourly chart, the GBP/USD pair on Friday reversed in favor of the British pound and returned to the resistance level of 1.3332 – 1.3357 after Trump announced his intention to raise tariffs on China to 100% starting November 1. Thus, traders are currently in a very favorable position. A close above the 1.3332 – 1.3357 level will allow expectations of continued growth toward the next corrective level of 76.4% – 1.3425. A close below this level will favor the U.S. currency and the resumption of a decline toward the Fibo level 127.2% – 1.3225.

The wave situation remains "bearish." The last completed upward wave failed to break the previous high, and the last downward wave did not break the previous low. The news background in recent weeks has been negative for the U.S. dollar, yet bullish traders are still not taking advantage of the opportunities presented to them. To cancel the "bearish" trend, the pair would need to rise above 1.3528, but for now, the bears remain on the offensive.

The first thing to note is that the U.S. government shutdown continues, which means that most of the key economic indicators that were supposed to be released this week will not be available to traders. In particular, this concerns important reports on retail sales and inflation. Let me remind you that the Federal Reserve bases its decisions on three "pillars": inflation, unemployment, and the labor market. None of these indicators (except for ADP) have been released in October. Thus, as long as the shutdown continues, neither traders nor the Fed will have any understanding of how September performed.

The new conflict between China and the U.S. is another negative factor for the dollar. Recall that the trade war has been the main reason for the dollar's decline this year. The more it escalates, the faster the U.S. currency will resume its downward trend. At least, that's how this equation looks to me. I had already expected a new decline in the dollar, since even those U.S. reports that did come out showed nothing promising for the American economy. I do not expect anything positive from the unreleased reports either, which will eventually become available sooner or later.

On the 4-hour chart, the pair has consolidated below the level 1.3339 – 1.3435, which allows us to expect a continuation of the downward movement toward the corrective level 76.4% – 1.3118. A consolidation of quotes above 1.3339 will favor the pound and some growth. No emerging divergences are currently observed in any indicator, and further growth of the U.S. dollar appears highly doubtful.

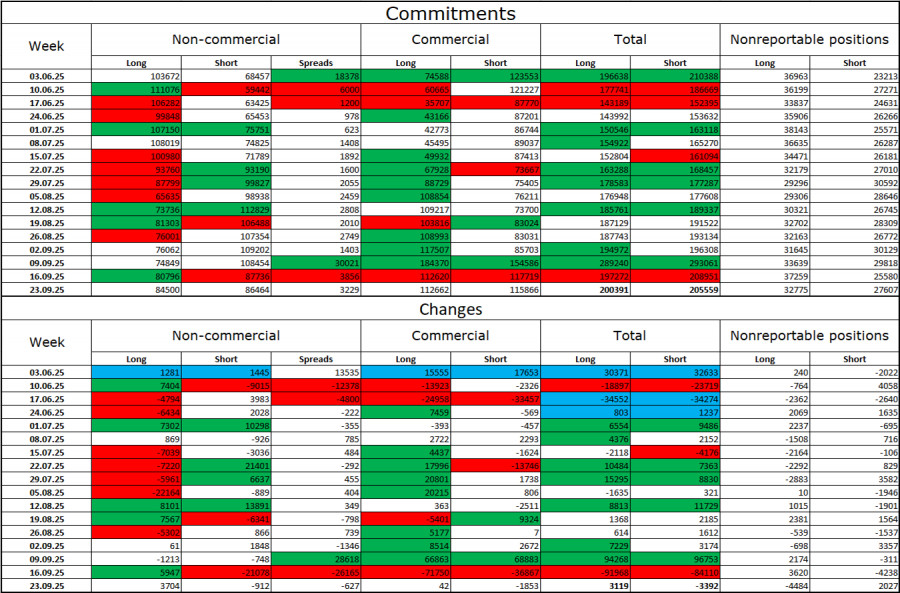

Commitments of Traders (COT) Report:

The sentiment of the Non-commercial trader category became more bullish over the last reporting week. The number of Long positions held by speculators increased by 3,704, while the number of Short positions decreased by 912. The gap between the number of Long and Short positions is now approximately 85,000 vs. 86,000. Bullish traders are once again tipping the scales in their favor.

In my view, the pound still has potential for a decline, but with each passing month, the U.S. dollar looks weaker and weaker. Previously, traders worried about Donald Trump's protectionist policies, not realizing what results they might bring. Now, however, they may be more concerned about the consequences of these policies: a possible recession, the constant introduction of new tariffs, and Trump's conflict with the Federal Reserve, as a result of which the regulator could become "politically controlled" by the White House. Thus, the pound now looks much less dangerous than the U.S. currency.

News Calendar for the U.S. and the U.K.:

On October 13, the economic calendar contains no noteworthy entries. The influence of the news background on market sentiment on Monday will therefore be absent.

Forecast for GBP/USD and Trader Recommendations:

Sales today are possible upon a close below the 1.3332 – 1.3357 level on the hourly chart, with a target of 1.3225. Purchases can be considered upon a close above the 1.3332 – 1.3357 level, with a target of 1.3425.

Fibonacci grids are built between 1.3332 – 1.3725 on the hourly chart and 1.3431 – 1.2104 on the 4-hour chart.