There are very few macroeconomic reports scheduled for Wednesday. Only in the United Kingdom will an inflation report for September be published in about an hour. Expert forecasts suggest that the Consumer Price Index will rise to 4.0%, which is double the Bank of England's target level. We believe that with such a level of inflation (or higher), which has also been rising for a whole year, there can be no talk of a new key rate cut. Thus, rising inflation may support the British currency. In Germany, the European Union, and the United States, no important reports are scheduled for today.

Few fundamental events are scheduled for Wednesday, and virtually none of them are of interest. Over the past few weeks, we have witnessed numerous speeches from representatives of the European Central Bank, BOE, and the Federal Reserve, so the positions of all three central banks are thoroughly understood. A new speech by Christine Lagarde today is unlikely to provide the market with food for thought. Let us recall that inflation in the Eurozone rose more than expected in September, which does not imply a new easing of monetary policy. However, even without the latest inflation report, the ECB was not inclined to lower the key interest rate. Thus, with the release of the new inflation report, nothing has changed.

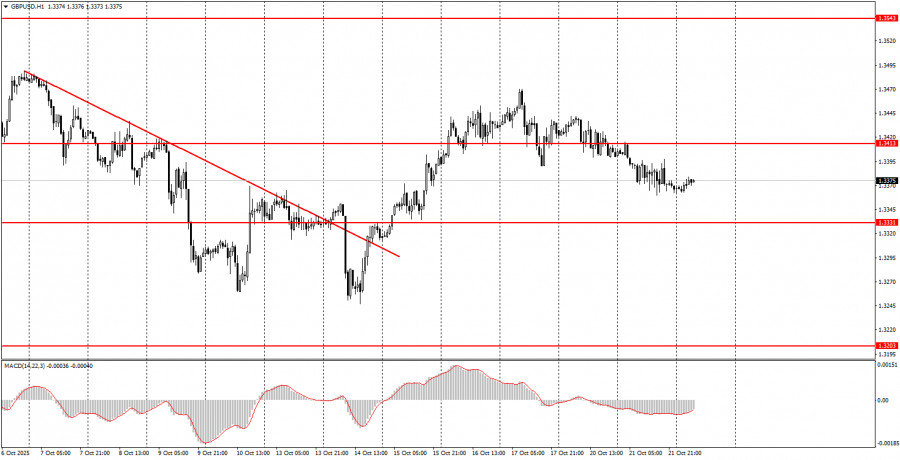

During the third trading day of the week, both currency pairs may once again remain in a low-volatility flat. The European currency has a good trading zone at 1.1571–1.1584, from which both long and short positions can be considered. The British pound is located precisely between the areas of 1.3329–1.3331 and 1.3413–1.3421. However, let us remind that market volatility is currently low, and the macroeconomic background is practically absent. Only the pound has a chance to show significant movement today due to the inflation report.

Important Note for Beginners

Trading during major news events (as listed on the calendar) can significantly impact price movement. During such times, trade cautiously or step out of the market entirely to avoid a sharp reversal against your position.

Beginners must remember that not every trade can be profitable. The key to long-term success in forex is maintaining a consistent strategy, reinforcing discipline, controlling risk, and following sound money management principles.