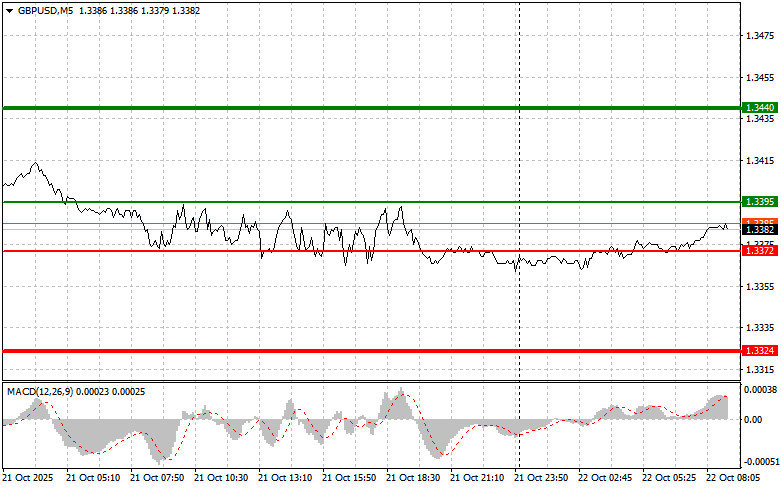

The test of the 1.3367 level coincided with the moment when the MACD indicator had just begun moving down from the zero mark, confirming a valid entry point for selling the pound. However, the pair did not experience a significant drop.

The British pound continues to decline against the US dollar—especially against the backdrop of ongoing geopolitical uncertainty and unresolved trade disputes between the United States and China. Investors are exercising caution due to the unpredictability of global trade and the potential impact on the UK economy, which is already facing political and economic challenges. Yesterday's data on the sharp increase in public sector borrowing confirms this pressure.

Today, all market participants' attention is focused on the upcoming release of the Consumer Price Index (CPI), Core CPI, and Retail Price Index (RPI) in the UK for September. These reports will serve as key indicators of the current inflation landscape in the country. Analysts will carefully assess the figures to understand the extent of inflationary pressure on the British economy and to gauge the Bank of England's potential policy response.

Should inflation data prove high, it may encourage the BoE to maintain a hawkish stance on interest rates. Such a move would likely support the pound sterling but could simultaneously act as a brake on economic growth, as more expensive credit would reduce business investment and consumer spending. Conversely, low inflation could prompt the BoE to consider easing monetary policy, which could weaken the pound but give a boost to the economy. Investors will weigh the potential risks and benefits to determine the most probable scenario going forward.

Particular attention will be paid to the Core Consumer Price Index, which excludes energy and food prices—components known for their high volatility. It provides a clearer view of underlying inflation trends. The Retail Price Index is also important, as it is used to adjust wages, pensions, and other social payments.

Regarding the intraday strategy, I will focus primarily on executing Scenarios #1 and #2.

Important: Beginner traders on the Forex market must be very cautious when making entry decisions. Before the release of key fundamental reports, it is generally best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit—especially if you do not use money management and trade with high volumes.

Remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for intraday traders.