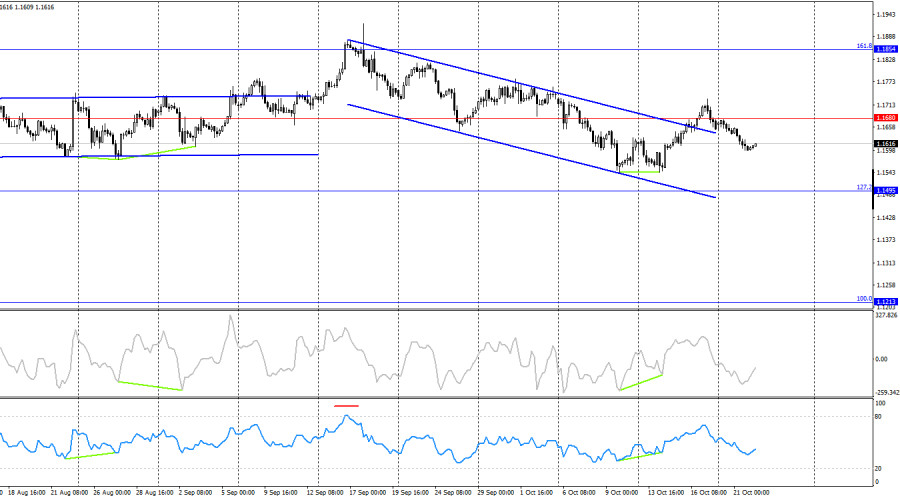

On Tuesday, the EUR/USD pair consolidated below the 1.1645–1.1656 level and continued its decline toward the 61.8% retracement level at 1.1594, which, as of Wednesday morning, was nearly reached. A rebound from this level would favor the European currency and signal a renewed rise toward the resistance level of 1.1645–1.1656 and the 38.2% retracement level at 1.1718 within the framework of a new bullish trend. Conversely, a consolidation below 1.1594 would point to further decline and most likely mark the end of the bullish trend.

The wave structure on the hourly chart remains simple and clear. The last upward wave broke the previous high, while the most recent completed downward wave failed to break the previous low. Thus, the trend has currently shifted to bullish. Recent labor market data, the changing outlook for the Fed's monetary policy, Trump's renewed aggression toward China, and the ongoing "shutdown" have all supported bullish traders. However, the bulls continue to attack very sluggishly — as if they simply don't want to, for reasons unknown.

On Tuesday, the news background in both the EU and the U.S. was once again quiet, aside from another speech by Christine Lagarde, who again avoided discussing monetary policy. Hence, there was effectively no market-moving news yesterday.

Many traders are now asking: why is the dollar rising again? In my view, there's no clear — or logical — explanation. Some experts suggest it's due to easing geopolitical tensions between the U.S. and China, as Trump has recently adopted a more conciliatory tone. However, I don't believe any real reconciliation has occurred. Only when Beijing and Washington actually hold talks and reach common ground can we draw conclusions about peace or further escalation — but not now, when no decisions have been made and no negotiations have even taken place.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar and consolidated below 1.1680, which suggests a potential for further decline. However, earlier the pair had also consolidated above the descending trend channel after forming a bullish divergence on the CCI indicator. Therefore, the upward movement could resume toward the next retracement level of 161.8% – 1.1854. Market movements remain weak, so I believe the hourly chart currently provides a more relevant picture.

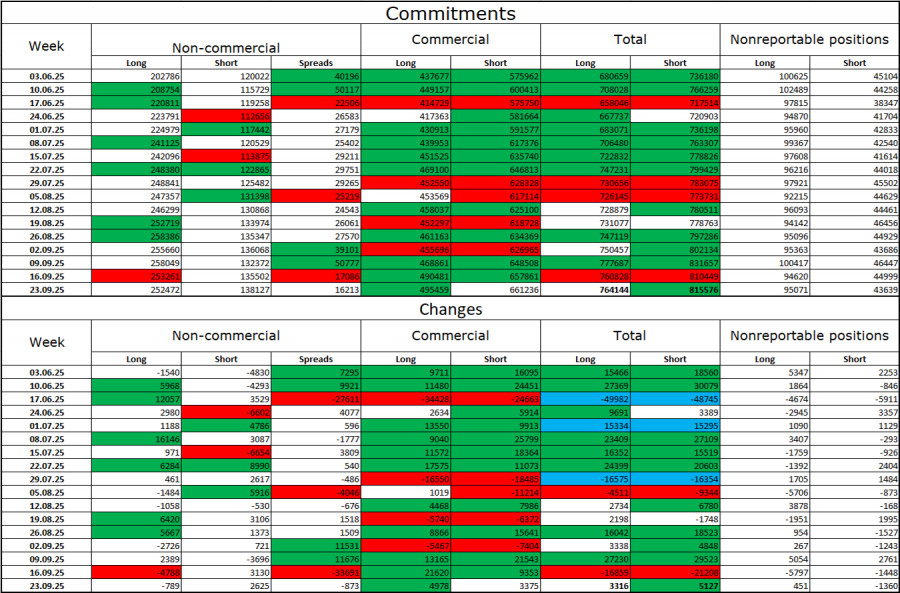

Commitments of Traders (COT) Report:

During the most recent reporting week, professional traders closed 789 long positions and opened 2,625 short ones. The sentiment among the Non-commercial group remains bullish — thanks largely to Donald Trump — and continues to strengthen over time. The total number of long positions held by speculators is now 252,000, compared to 138,000 short positions — nearly a twofold difference.

Also note the number of green cells in the table above, indicating strong growth in positions on the euro. In most cases, interest in the euro continues to rise while interest in the dollar declines.

For thirty-three consecutive weeks, large players have been cutting short positions and increasing long ones. Donald Trump's policies remain the most significant factor for traders, as they could cause numerous long-term, structural problems for the U.S. economy. Despite the signing of several key trade agreements, many major economic indicators continue to show weakness.

News Calendar for the U.S. and the Eurozone:

On October 22, the economic calendar contains only one entry of potential interest to traders. The influence of the news background on market sentiment on Wednesday is expected to be weak or nonexistent.

EUR/USD Forecast and Trading Recommendations:

Sales were possible after a rebound from 1.1718 on the hourly chart, targeting 1.1656. New short positions became viable after a close below the 1.1645–1.1656 level, targeting 1.1594. That target has now been almost reached.

New short trades can be considered upon a close below 1.1594, targeting 1.1517. Long positions can be considered today in case of a rebound from 1.1594, with targets at 1.1645–1.1656.

The Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.