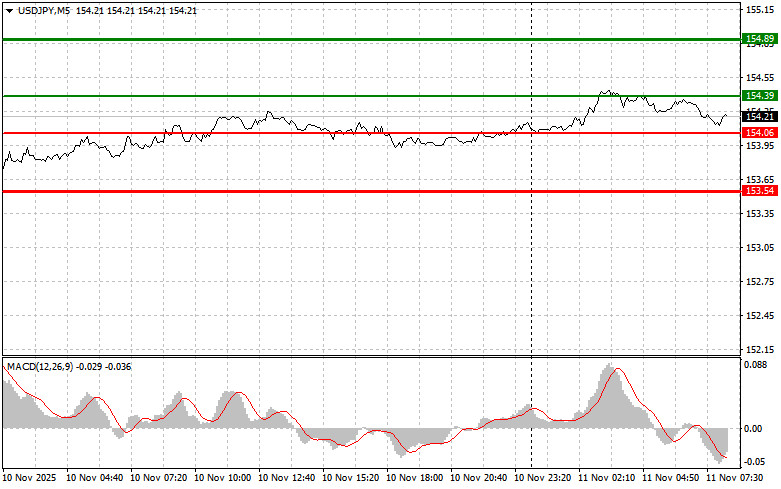

The test of the 154.00 price coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the dollar.

The dollar rose against the yen after the U.S. Senate approved a bill to end the shutdown. This reaction, while moderate, reflects the market's overall fatigue with political uncertainty in the U.S. Weeks of the shutdown, with its consequences for the economy and investor sentiment, have eroded confidence in the American currency. Therefore, the news of a potential resolution to the crisis, although preliminary, was received positively. However, market optimism remains cautious. Investors understand well that Senate approval is only the first step. The vote in the House of Representatives, especially considering the political polarization in the U.S., poses another serious test. If the House does not support the bill, the dollar may come under pressure again. Additionally, even if the vote is successful, the impact of the shutdown on economic indicators is already felt. Delays in data collection, disruptions in the operations of federal agencies, and the potential blow to consumer confidence will inevitably reflect on economic growth in the first quarter. Therefore, while the dollar has risen against the yen, this rise should be viewed as a short-term reaction to the news rather than the start of a long-term upward trend. Moving forward, the dollar's dynamics will depend not only on U.S. political events but also on macroeconomic data and the Federal Reserve's interest rate decisions. Furthermore, the ongoing statements from the Japanese Ministry of Finance that the current yen rate raises concerns could lead to interventions by the regulator, which decreases willingness to buy USD/JPY at the proposed levels of 154 yen per dollar.

Regarding the intraday strategy, I will rely more on the execution of Scenario #1 and Scenario #2.

Scenario #1: I plan to buy USD/JPY today if it reaches an entry point around 154.39 (the green line on the chart), targeting a move to 154.89 (the thicker green line on the chart). Around 154.89, I intend to exit the long positions and open shorts immediately in the opposite direction, expecting a 30-35-pip move back from this level. It is best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I will also consider buying USD/JPY today if there are two consecutive tests of 154.06 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 154.39 and 154.89 can be expected.

Scenario #1: I plan to sell USD/JPY today only after the price updates to 154.06 (the red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 153.54 level, where I intend to exit the shorts and buy immediately in the opposite direction (expecting a 20-25-pip move back from this level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I will also consider selling USD/JPY today if there are two consecutive tests of 154.39 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 154.06 and 153.54 can be expected.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.