As gold hits another level around $4,186, having rebounded well from the $3,900 mark it reached earlier this month, JP Morgan Private predicts that the rapid increase in gold prices is likely to push prices above $5,000 per ounce next year, primarily driven by purchases from central banks in developing economies.

The bank believes that by the end of 2026, prices could reach $5,200-$5,300. Central bank purchases have become a key factor in the surge in gold prices this year, as policymakers look for ways to preserve value and diversify assets. Prices reached record highs, surpassing $4,380 in October, before declining in recent weeks. Since the start of the year, the value of the precious metal has still risen by over 50%.

However, JPMorgan observes that the share of gold in the foreign reserves of many central banks, especially in emerging markets, remains relatively low. While the pace of purchases may slow due to high prices, the demand for gold is expected to persist.

Yet, behind this optimistic outlook are certain risks. Firstly, the strengthening of the US dollar, supported by the Federal Reserve's tightening policy, may suppress gold prices, as there is a traditional inverse correlation between the two assets. Secondly, an unexpected decrease in global inflation could dampen investors' interest in gold as a hedge against inflation risks.

Ultimately, achieving the $ 5,000-per-ounce mark will depend on a combination of factors, including macroeconomic conditions, geopolitical risks, and actions by major players in the gold market.

According to the World Gold Council, central banks increased their reserves by 634 tons over the course of the year. While this is lower than the corresponding period in each of the last three years, it still significantly exceeds the average figure prior to 2022. The World Gold Council forecasts annual purchases in the range of 750 to 900 tons. China remains the primary driver of purchases, seeking to reduce the world's dependence on US-centric financial markets. Poland, Turkey, and Kazakhstan have also been adding to their gold reserves.

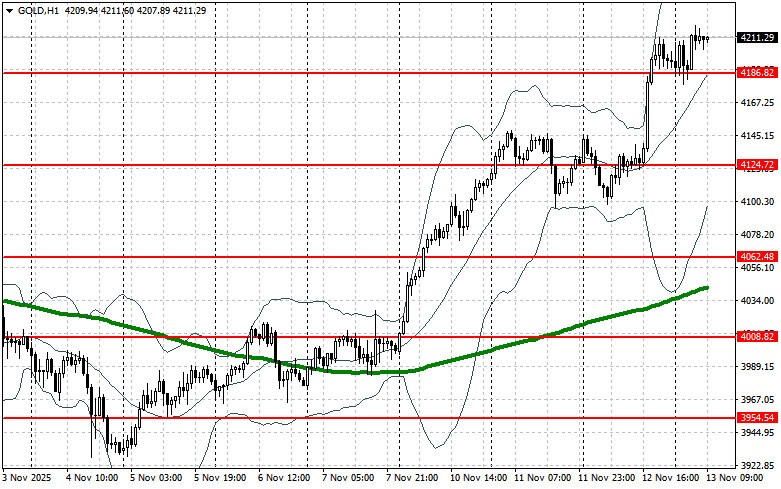

As for the current technical picture of gold, buyers need to overcome the nearest resistance at $4,296. This will allow them to target $4,304, above which it will be quite challenging to break through. The furthest target will be around $4,372. Should gold decline, bears will try to take control of $4,186. If successful, breaking this range would deal a significant blow to the bulls' positions and push gold down to a low of $4,124, with the potential to reach $4,062.