Analytici Barclays v poznámce uvedli, že prudká reakce trhu na nedávný kybernetický útok na Coinbase (NASDAQ:COIN) a samostatné regulační vyšetřování je „pravděpodobně přehnaná“, i když akcie na základě těchto zpráv prudce poklesly.

Kryptoměnová burza odhalila, že několik jejích zahraničních pracovníků podpory bylo podplaceno, aby ukradli údaje zákazníků v rámci hackerského útoku založeného na sociálním inženýrství.

Podle společnosti útočníci získali přístup k osobním údajům, jako jsou jména, adresy, maskovaná čísla sociálního zabezpečení a údaje o bankovních účtech, ale nezískali hesla, soukromé klíče ani přístup k peněženkám zákazníků.

Bylo postiženo méně než 1 % uživatelů provádějících transakce.

Barclays poznamenal, že „kybernetický incident není nikdy pozitivní“, ale firma věří, že Coinbase „přijímá vhodná opatření k řešení incidentu“, včetně odmítnutí zaplatit výkupné ve výši 20 milionů dolarů, náhrady škody postiženým klientům a spolupráce s orgány činnými v trestním řízení.

Barclays zdůraznil, že „problém byl výsledkem sociálního inženýrství, a nikoli selhání základní technologie blockchainu“.

Média samostatně informovala, že Komise pro cenné papíry a burzy (SEC) vyšetřuje, zda Coinbase ve své žádosti o IPO v roce 2021 nadhodnotila počet ověřených uživatelů.

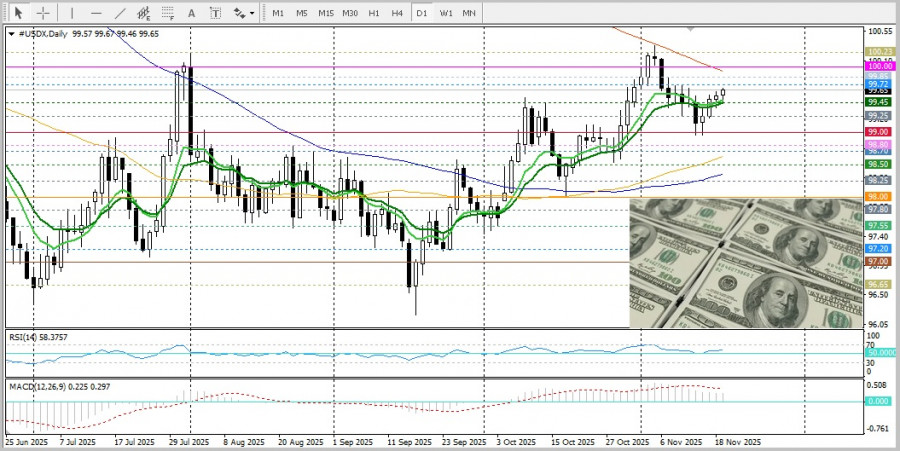

The USD/CHF pair continues its recent rise from the November low of 0.7880 reached last week and has remained positive for the fourth straight day. The pair has now surpassed the round 0.8000 level, with bulls attempting to build on the momentum and break above the 100-day Simple Moving Average (SMA).

The Swiss franc remains relatively stable amid fresh data indicating that Switzerland's export-driven economy contracted in the third quarter for the first time in two years. In contrast, the U.S. dollar is approaching a weekly high, supported by a reduced likelihood of a Federal Reserve rate cut in December. This has become an important driver of USD/CHF strengthening. However, bullish sentiment toward the dollar remains cautious: concerns about worsening economic conditions due to the prolonged U.S. government shutdown are preventing bulls from opening aggressive positions. Therefore, to gain clarity on future Federal Reserve monetary policy decisions and U.S. dollar direction, attention should be paid to the upcoming FOMC meeting minutes. They may significantly influence the USD/CHF pair's dynamics.

However, bullish sentiment toward the dollar remains cautious: concerns about worsening economic conditions due to the prolonged U.S. government shutdown are preventing bulls from opening aggressive positions. Therefore, to gain clarity on future Federal Reserve monetary policy decisions and U.S. dollar direction, attention should be paid to the upcoming FOMC meeting minutes. They may significantly influence the USD/CHF pair's dynamics.

This week also brings the Non-Farm Payrolls (NFP) report for September, scheduled for release on Thursday. Signs of labor market weakness are already emerging. At the same time, increased demand for safe-haven assets and expectations that the Swiss National Bank (SNB) will keep its key rate at 0% in December — despite rising inflation expectations — may support demand for the franc. These factors may limit the upside for USD/CHF, creating a balance of risks and opportunities.

From a technical perspective, oscillators on the daily and 4-hour charts are positive. Prices are attempting to break through the 0.8015 level, where the 100-SMA lies on the 4-hour chart. A successful breakout would open the path toward 0.8060 and then toward the round 0.8100 level.

On the other hand, if prices fail to hold above the round 0.8000 level, support will be found near 0.7990. Failure to hold this support may accelerate the decline toward 0.7975 and then to 0.7940, on the way to the round 0.7900 level.