Ekonomové oslovení agenturou Reuters nyní předpokládají, že britská ekonomika letos poroste tempem 1,0 %, tedy mírně rychleji než dříve očekávaných 0,9 %. Důvodem je lepší výsledek v prvním čtvrtletí a pozitivní dopad nové obchodní dohody s USA.

Dohoda s USA sice zachovává 10% clo na britské zboží, ale snižuje cla na automobily a ocel, což přispělo k mírnému zlepšení nálady.

Bank of England se podle průzkumu chystá snížit úrokové sazby jednou za čtvrtletí, přičemž další snížení se očekává v srpnu a poté v listopadu – na konci roku by měla být sazba 3,75 %.

At first glance, there are quite a few macroeconomic reports scheduled for Tuesday. However, most of them do not seem interesting at this point. It is worth recalling that the market has already ignored the ISM report in the U.S. and the inflation and unemployment reports from the Eurozone this week. What are the chances that it will react to the second estimates of service sector PMI indices from Germany, the EU, and the UK? Therefore, these data can be safely overlooked. The only American releases that pique interest include the ADP labor market report, the ISM Services Activity Index, and industrial production data. These reports could provoke a completely illogical market reaction, but they should still not be ignored.

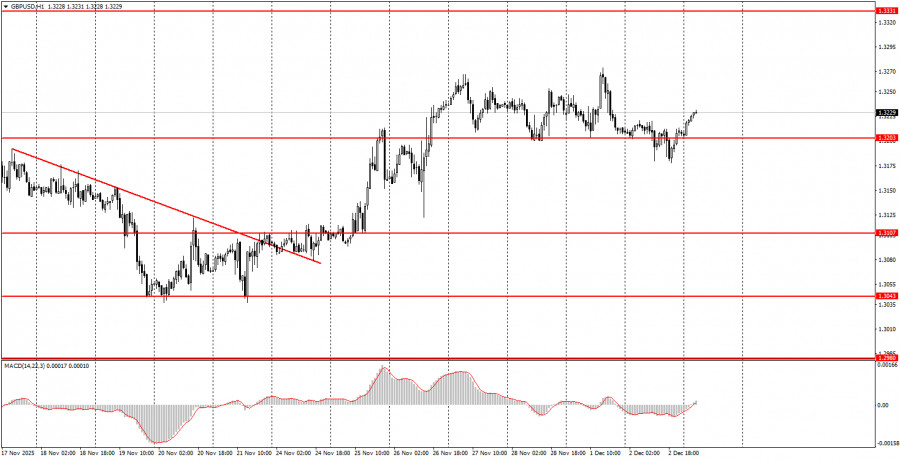

On the third trading day of the week, both currency pairs are likely to trend upward, as an upward trend continues to form in both. The euro has a great trading area at 1.1655-1.1666. The British pound has an area at 1.3203-1.3211 and is currently in a range. Volatility on Wednesday may remain low, but there could still be some emotional spikes during the American trading session.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.