As usual, the market reacted sharply to the results of the last FOMC meeting, then began to reassess the Fed's agenda before shooting up again. As a result, the bears in EUR/USD showed no signs of counterattacking, and the initiative was completely seized by the bulls. The major currency pair soared to its highest level since mid-October, and I fear this might not be the limit.

At first glance, everything unfolded just as expected. The federal funds rate fell from 4.00% to 3.75%, and Jerome Powell stated that the Fed feels comfortable. Borrowing costs shifted to neutral levels that neither stimulate nor cool the economy. Everything went according to plan; however, the swift rise of the euro suggests that the central bank delivered a "dovish" surprise.

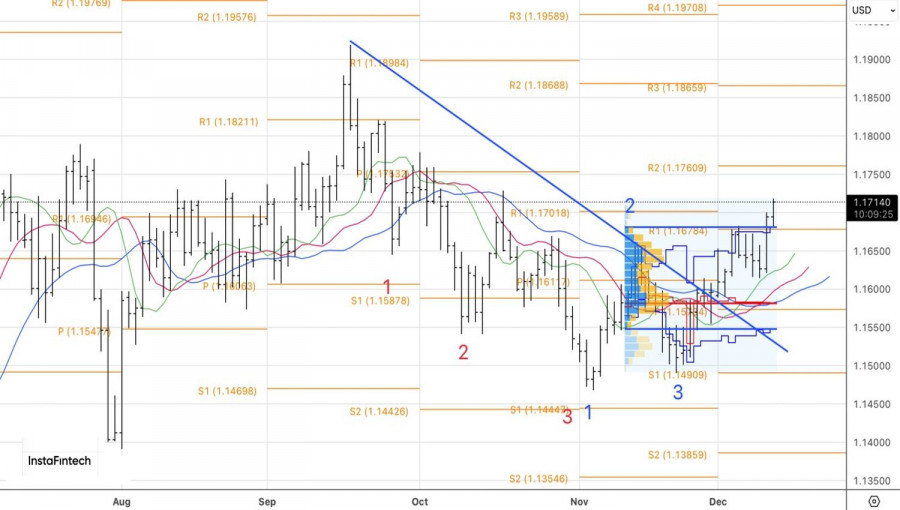

Market expectations for the Fed's key interest rate

Surprisingly, the futures market has lowered the odds of a monetary policy easing in January to 20% and does not expect rate cuts until April. However, it should be understood that investors were hoping for nearly five dissenting hawks, but they actually got only two.

The Fed's announcement of the resumption of QE also contributed to the decline of the USD index. The central bank will begin purchasing bonds in the amount of $40 billion. This was presented as an intention to calm the repo market. However, it could actually become part of the American administration's plan to lower Treasury yields. It's no surprise that talk of fiscal dominance and threats to the independence of the Fed is circulating in the market again.

Inflation expectations in the US

Adding to this are Jerome Powell's concerns about cooling labor market conditions and downward revisions to the inflation forecast for 2026 from 3.0% to 2.5%, which clarifies the situation. The doves have outmaneuvered the hawks, indicating that the cycle of monetary policy easing will continue. And with that, the upward trend in EUR/USD is likely to persist.

The major currency pair didn't even wait for the employment report outside of the agricultural sector for October and November, due on December 16, nor the potential drop in stock indices due to Oracle's issues. The euro took the bull by the horns and surged northward. In a week, the ECB will likely signal the end of the monetary expansion cycle and may even discuss an increase in deposit rates. In such conditions, how can the US dollar compete with the single European currency?

The divergence in monetary policy between the European Central Bank and the Federal Reserve has faithfully served and is still benefitting the bulls in EUR/USD.

Technical picture

From a technical viewpoint, on the daily chart of the major currency pair, the breakout of the upper border of the short-term consolidation range of 1.1615-1.1660 has allowed for the accumulation or establishment of long positions. These should be held, and EUR/USD could be bought periodically. Target levels are set at 1.1760 and 1.1865.