The GBP/USD currency pair showed a volatility of 37 pips on Friday. There were no market movements, despite several macroeconomic reports in the UK and the U.S. Earlier in the week, key data on the labor market, unemployment, and inflation were released in the U.S., along with the Bank of England meeting, where a decision to lower the key rate was made. Reports on UK business activity, unemployment, and inflation were also published. Yet, all that traders got this week was a flat market.

If traders couldn't determine the direction of movement last week, the likelihood of a trending movement this week is even lower. Of course, in a "thin" market, movements can occur. But they will likely not be driven by macroeconomic or fundamental factors. All the most interesting events happened last week. The market learned everything it wanted to know. This week, most traders will be celebrating. Nevertheless, a few reports will be released in the UK and the U.S., so it would be a shame not to consider them.

In the UK, the third estimate of GDP will be released on Monday. From our perspective, this third estimate is important, but it rarely differs significantly from the first or second estimates. It is expected that the British economy grew by 0.1% quarter-on-quarter and 1.3% year-on-year. Actual values may be lower. A market reaction is likely only if there is a significant deviation from the forecasts. However, even in that case, strong movement should not be anticipated.

On Tuesday, U.S. GDP data will be published. Experts expect growth of 3.2%, but the actual figure may be lower again. However, this release will only be the second estimate, which is objectively the least significant. On the same day, durable goods orders will be published, and the report could provoke a noticeable reaction. The strength of that reaction will depend on how far the actual value deviates from the forecast. On Tuesday, there will also be a report on industrial production, which traders may pay attention to.

There are no more significant events scheduled in the UK or the U.S. for the rest of the week. Technically, in the short term, the GBP/USD pair is in a flat, which is visible on the hourly timeframe, while in the long term, it remains in an upward trend. On the daily timeframe, the Senkou Span B line has been breached, which we consider to be a very important moment. Essentially, the British currency may continue to grow even without a downward correction. The key is to break out of the flat on the hourly timeframe through the upper line.

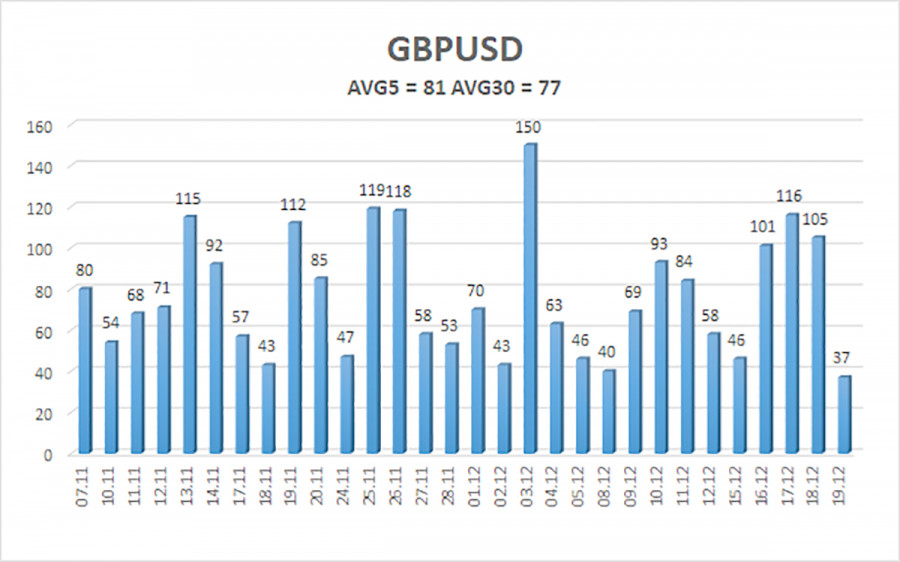

The average volatility of the GBP/USD pair over the last five trading days is 81 pips, which is considered "medium." We expect the pair to trade between 1.3294 and 1.3456 on Monday. The upper linear regression channel is pointing down, but it is only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold area 6 times in recent months and has formed numerous bullish divergences, consistently signaling a resumption of the upward trend. This week, the indicator formed yet another bullish divergence, but previously there had been two entries into the overbought area and a bearish divergence. The pound is confidently moving toward another flat.

The GBP/USD pair is trying to resume the upward trend of 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to pressure the dollar, so we do not expect the U.S. currency to grow. Thus, long positions with targets at 1.3489 and 1.3550 remain relevant for the near term as long as the price is above the moving average. If the price is below the moving average, small short positions can be considered with targets at 1.3306 and 1.3245 based purely on technical factors. From time to time, the U.S. currency shows corrections (in a global context), but for a trend strengthening, it needs signs of an end to the trade war or other global positive factors.