Paříž – Jihovýchodní francouzský departement Alpes-Maritimes se od dnešního dopoledne potýká s rozsáhlým výpadkem elektřiny, kvůli kterému se desetitisíce domácností ocitly bez proudu. Napsal to web France Info. V oblasti se nachází město Cannes, kde dnes vrcholí mezinárodní filmový festival, jehož průběh ale nebude podle všeho narušen.

The S&P 500 has done what it needed to do, setting its 39th record in 2025 during thin pre-Christmas trading. With trading volumes declining and a slight bullish bias in the air, the broad market index had little choice but to climb. This time, the euphoria among buyers was linked to optimism regarding the US economy and expectations for Federal Reserve rate cuts.

After an impressive report showing US GDP growth of 4.3% in the third quarter, investors were further encouraged by a decrease in initial unemployment claims to 214,000 for the week ending December 20. Coupled with news that Apple CEO Tim Cook purchased $2.9 million worth of Nike shares, this was enough to sustain the S&P 500 rally, especially as volatility in the US stock market had reached its lowest levels since the beginning of the year.

Dynamics of US Stock Market Volatility Index (VIX)

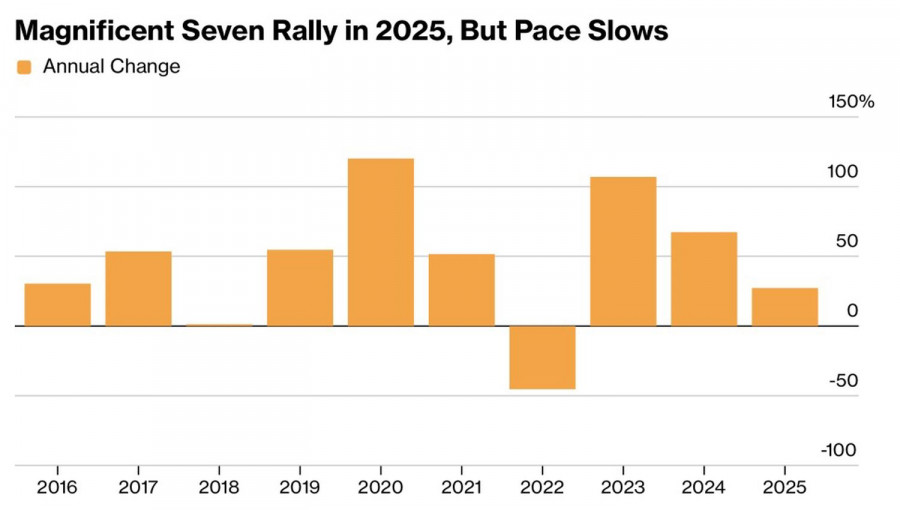

The impact of Nike's stock increase on the broad market index represents another chapter in the influence of major companies on the S&P 500. For several years, the Magnificent Seven stocks have been the primary driver of the US stock market rally, although returns on investments in them are gradually declining.

The S&P 500 is poised to grow by 18% in 2025, heading toward its third consecutive year of double-digit gains. CFRA claims that replicating this performance in 2026 will be nearly impossible. Since 1945, the broad market index has recorded only one four-year stretch with annual gains exceeding 10% (from 1949 to 1952) and one five-year stretch (from 1995 to 1999). While nothing is impossible in the market, the odds are slim.

Returns on Investments in Magnificent Seven

The Christmas rally will eventually pass, and investors will undoubtedly remember the underlying issues, particularly concerns about the fundamental overvaluation of technology stocks and their inability to generate adequate profits relative to investments. The only way to recognize a bubble is to wait for it to burst. While this may not occur in 2026, traders need to remain alert. A full-scale S&P 500 crash would not only impact financial markets but also the global economy.

However, Donald Trump remains confident that this will not happen. The president aims to appoint a Federal Reserve chair who will lower interest rates to support stock indices, rather than hinder them. The paradox is that markets are wary of his favored candidate, Kevin Hassett, as he is perceived to be too close to the White House. The risks of the Fed potentially losing its independence have not been forgotten.

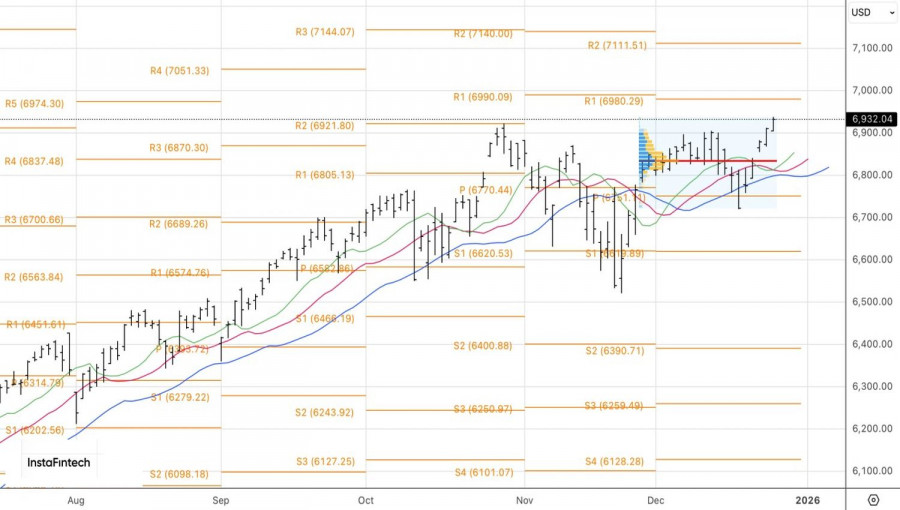

From a technical perspective, the daily chart of the S&P 500 indicates a resumed upward trend. Quotes are moving away from the moving averages, suggesting the strength of bulls. The previously set targets of 6,990 and 7,100 are coming closer. In this context, it makes sense to hold and gradually increase previously established long positions in the broad market index.