The price of gold has risen, holding above the $5,000 per ounce mark for the second consecutive day. The weakening of the US dollar has contributed to the continued surge in metal prices, driven by geopolitical risks and investor flight from government bonds and currencies.

Today, precious metals jumped by 1.4%, marking a seventh consecutive day of growth. This occurred right after US President Donald Trump threatened to raise tariffs on South Korean goods, and the key dollar index fell further amid growing speculation that the US may help Japan support the yen. Silver rose by more than 7%.

The prospect of further escalation of conflicts in the Middle East and Iran fuels fears of instability in the global economy. Investors seeking refuge from stock market volatility and currency depreciation are increasingly turning to gold, traditionally seen as a reliable safe-haven asset. The decline in confidence in government bonds, particularly in the US and Europe, enhances gold's appeal as an alternative capital preservation tool.

As mentioned earlier, the sharp rise in gold prices—having more than doubled in the last two years—emphasizes the historical role of the precious metal as an indicator of market fear. After the best annual growth since 1979, gold has already risen by 17% this year, mainly due to so-called depreciation trading, where investors abandon currencies and treasury bonds. The massive sell-off in the Japanese bond market is the latest example of investors rejecting significant government expenditures.

According to the largest European asset management company, Amundi SA, the growing isolation of America from other countries is prompting many investors to reduce their investments in dollar-denominated assets and shift towards gold. "In the long term, gold is a very good hedge against depreciation and a good way to preserve some purchasing power," stated Amundi.

Many investors are also protecting themselves from risk, as it remains uncertain who will be the next Fed chair. A softer stance from the chair will strengthen expectations for further interest rate cuts this year, which will positively affect non-yielding precious metals. It is widely anticipated that the US central bank will stop its cycle of rate cuts this Wednesday, as labor market stabilization restores a certain degree of consensus after several months of increasing disagreements within the Fed.

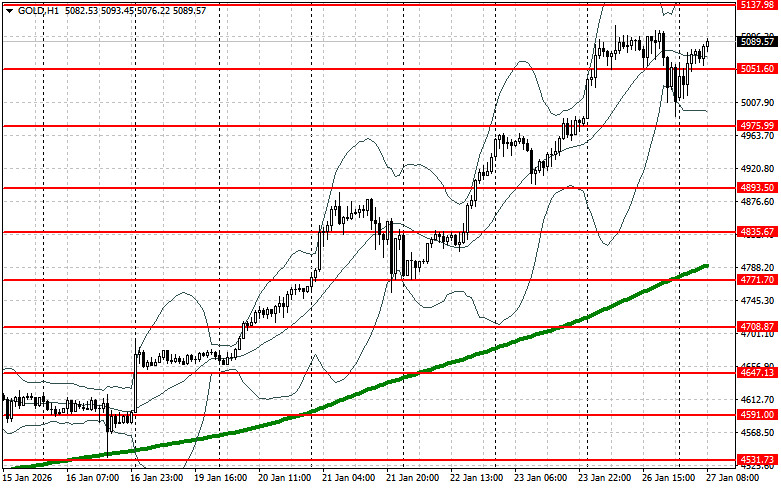

As for the current technical picture of gold, buyers need to break through the nearest resistance at $5,137. This will allow them to target $5,223, above which it will be quite problematic to break through. The next target will be the $5,317 area. In case of a decline in gold, bears will attempt to take control of $5,051. If they succeed, the breakout will deal a serious blow to the bulls' positions and drive gold down to a low of $4,975 with the potential to reach $4,893.