The outcome of the January Fed meeting and the nomination of Kevin Warsh create favorable conditions for further strengthening of the US dollar, especially in light of expectations for tougher measures to control inflation. However, the market remains cautious.

The US dollar is firming again, and the USD index (DXY) maintains upward momentum after two important events: the Fed meeting that concluded last Wednesday and President Trump's nomination of Kevin Warsh for Fed chair on Friday.

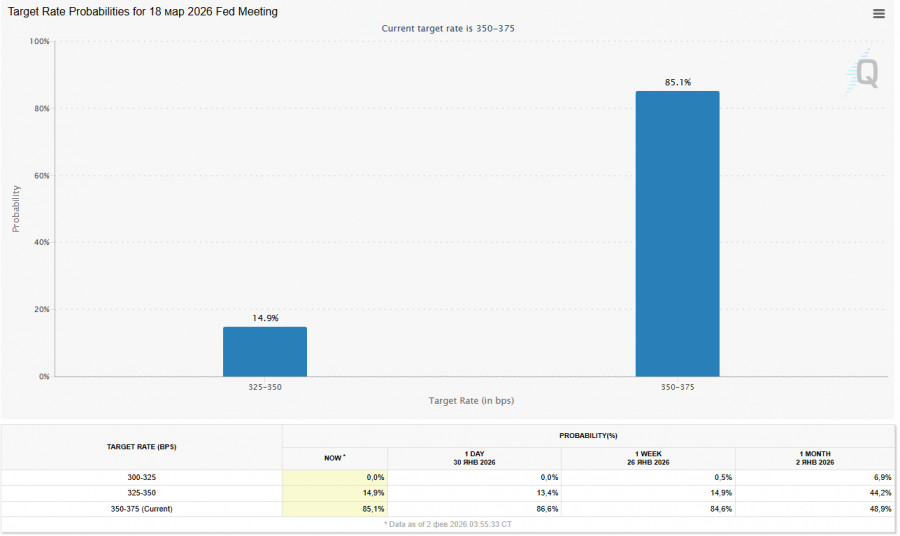

As is known, the Federal Reserve decided to keep the policy rate in the 3.50–3.75% range, and the accompanying statement noted that incoming macroeconomic data point to a resilient US economy, a recovery in consumer activity, and signs of labor?market stabilization, while inflation remains high and still exceeds the 2% target. Fed Chair Powell said the central bank board is focused on fulfilling its mandate to ensure both price stability and maximum employment.

Thus, the Fed decision was perceived by markets as a signal of a longer pause before the next easing of monetary conditions, and Warsh's nomination — given his reputation for a hawkish stance against inflationary pressure — further increased the odds that the policy rate will remain in the current 3.50–3.75% band.

A sharp drop in gold and other traditional safe haven assets accompanied the dollar's strengthening.

The CME FedWatch tool signals a high probability that the Fed will maintain a hawkish stance and has pushed the chance of the rate remaining unchanged at the next meeting (March 17–18) to a record 85%.

Technical picture

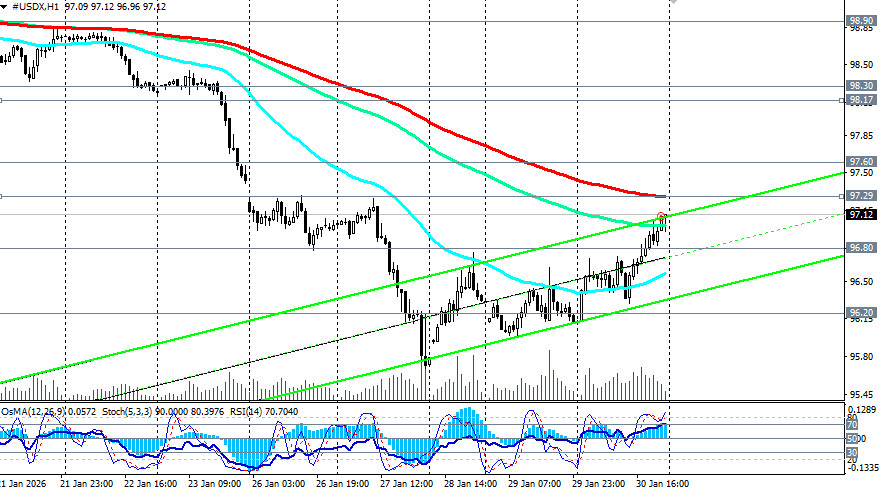

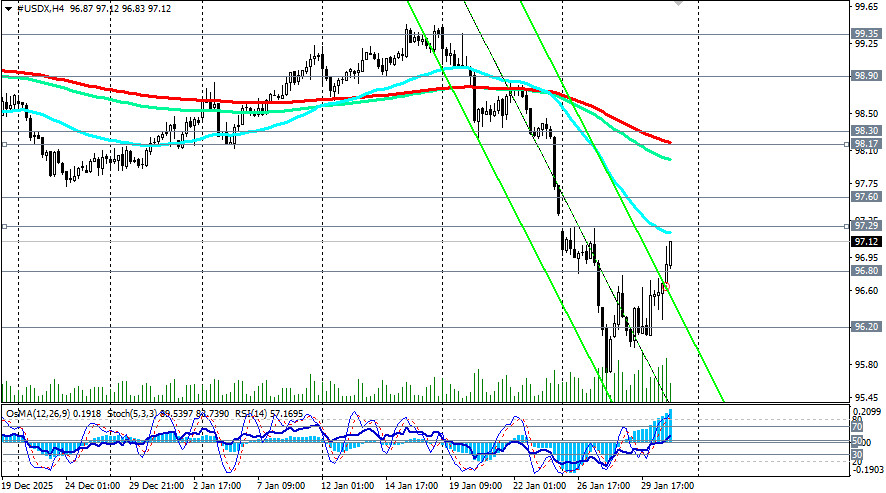

Technically, the dollar index (DXY) is in a short?term upward correction, moving toward the important resistance level at 97.29 (200?period EMA on the 1?hour chart). If that level is broken, it will climb to the resistance zone around 98.17 (200?period EMA on the 4?hour chart) and 98.30 (50?period EMA on the daily chart).

At the same time, below the key resistance levels of 99.35 (200?period EMA on the daily chart) and 101.15 (50?period EMA on the weekly chart), the index remains in a medium? and long?term bear market, which keeps the advantage with short positions.

Therefore, the correction may be limited by resistance levels at 97.29, 98.00, 98.17, and 98.30.

There remains the risk of renewed declines and a retest of the key strategic support zone at 96.80, 96.20, and 96.00, if market sentiment turns against the dollar.

Only a break above the key long?term resistance levels at 101.15 and 101.35 (144?period EMA on the weekly chart) would finally reassure dollar bulls and return the USDX into a long?term bear?market area.

What's on the calendar today?

Market participants' focus for the upcoming US session is the ISM manufacturing PMI for January, scheduled for release at 15:00 GMT. A modest improvement to 48.3 is expected versus December's 47.9, which would be a positive factor for the USD. Investors will also closely watch Fed officials' comments on monetary policy and US economic prospects, particularly remarks by Raphael Bostic, President of the Federal Reserve Bank of Atlanta (18:25 GMT).

Conclusion

The Fed's January meeting outcome and the nomination of Kevin Warsh create favorable conditions for further dollar strength, especially given expectations for tougher inflation control. However, the market remains on edge ahead of major economic releases — including Friday's Non?Farm Payrolls and ISM PMI data for manufacturing and services due this week — underscoring the need for careful analysis of the Fed's next steps. Geopolitical developments and the often?unexpected actions of President Trump and the White House add further reasons for caution.