The dollar will continue to strengthen its positions against the euro, pound, Japanese yen, and other currencies.

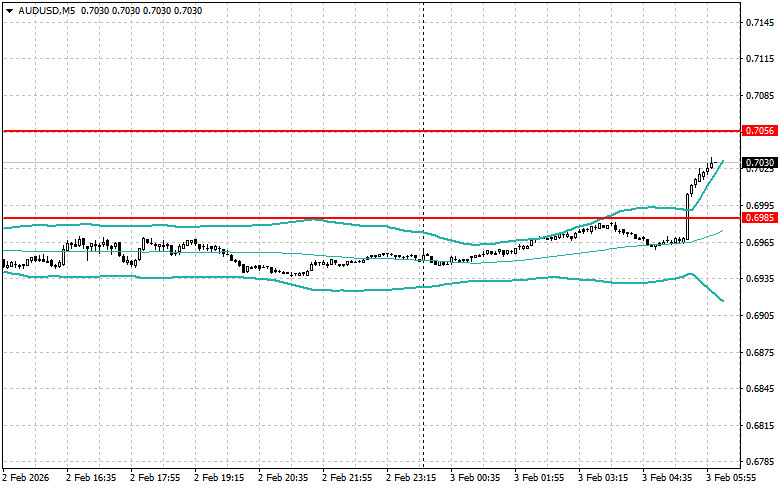

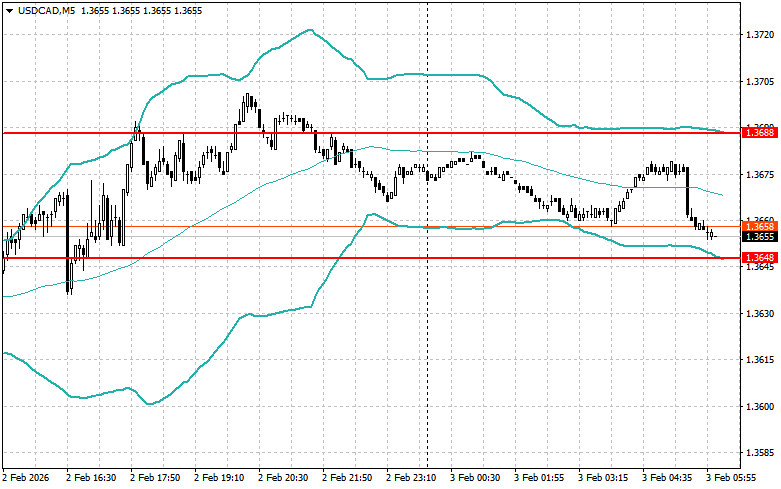

Yesterday's positive data showing that the ISM Manufacturing Index for the US returned above the 50-point mark sparked a new wave of purchases of the US dollar. Traders interpreted this as a signal of potential improvements in economic prospects, which in turn fueled expectations for a future stable policy from the Federal Reserve. The strengthening of the American currency has put pressure on other currencies, especially those considered riskier. Overall, the market's reaction to the ISM data indicates increased sensitivity to signals about the state of the US economy and its impact on global financial flows. Further developments will depend on incoming data and the rhetoric of Fed representatives.

Today promises to be eventful in the financial markets. In the first half of the day, special attention will be paid to the release of consumer price index data from France, which is an important inflation indicator for the Eurozone. Exceeding forecasted values could provoke expectations for a more aggressive monetary policy from the European Central Bank, potentially strengthening the euro. Conversely, lower-than-expected figures could put pressure on the single currency, heightening concerns about deflation.

An equally important event will be the publication of unemployment change data from Spain. A significant reduction in the number of unemployed could serve as a signal of economic recovery in Spain, supporting the euro. Otherwise, a substantial increase in unemployment could raise concerns about the sustainability of the country's economic growth, negatively impacting trader sentiment.

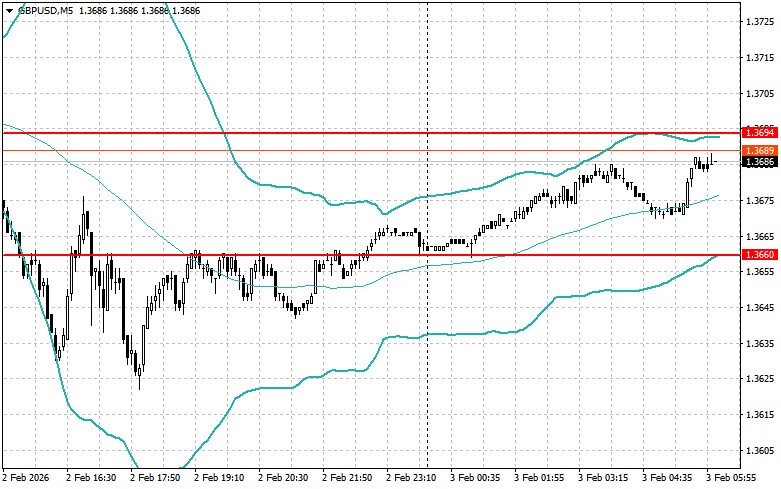

As for the pound, there are no significant data scheduled for the UK today, so the pair may continue its recovery after yesterday's sell-off.

If the data aligns with economists' expectations, it's best to act according to the Mean Reversion strategy. If the figures are significantly above or below economists' expectations, the Momentum strategy is preferable.